Key Highlights

- Current market conditions are prime for selling a business. The market is experiencing high multiples due to plentiful dry powder held by private equity firms, record amounts of cash held by strategic corporate buyers, a low interest rate environment, and high prices for publicly-traded equities.

- The time it takes to sell generally ranges from five to twelve months. The determining factors around timing include the size of your business and the dynamic balance between buyers and sellers in the market.

- Valuations are more of an art than a science. The best business valuation methods typically involve cash-flow. Still, the three most commonly utilized valuation calculations are the discounted cash flow, market multiples, and asset valuation.

- The best practices for maximizing shareholder value include the following:

- Make sure the business can thrive without you. You need a management team or key employees that can continue to drive cash flow, especially if you plan to exit the business or will have limited involvement in day-to-day operations. You should also broaden your customer base so that the business is not at risk if a couple key customers leave post-sale.

- Learn the dynamics driving acquisitions in your industry. Many business owners spend their time focused on keeping the business running instead of devoting energy to planning for its sale. Stay apprised of the motivations for financial and strategic buyers in your industry, as this can help you negotiate a higher exit value.

- Hire the right advisors. Don’t do it alone. An experienced M&A advisor can market your company to a larger group of potential buyers than you can access on your own. Early engagement of an independent valuation specialist can provide a market check on valuation and allow you to incorporate value drivers into your pre-sale planning.

- Examine and adjust operational efficiencies strategically. If necessary, it could be worth adopting efficient operating procedures before the sale. This may involve investments in new equipment or technology or changes in staffing.

- Factor tax considerations into sale decisions. Decisions around how to sell your business (merger, sale of stock, sale of assets) should consider tax implications carefully. It is also important to anticipate changes in tax law.

Investing in the Sale

For many business owners, their business represents the culmination of their life’s work and a primary source of wealth. The reasons leading one to sell a business can vary—perhaps a competitor has presented you with an unsolicited, lucrative offer. Or, perhaps you are simply ready to retire. Regardless of your motivation, the sale process can prove to be complex, with considerations including the right time to sell, whether or not to employ advisors, which business valuation method to use, and how to maximize the valuation. Therefore, when thinking about how to sell a business, you will want to maximize the value through a combination of planning and timing. Building a solid exit plan can take several years, and business owners ideally should start planning for a sale 3-5 years before they wish to transition out. You’ve invested in growing your business. When it comes time to sell your business, you must do the same.

The following analysis will help you understand the current acquisition market environment, how long it takes to sell businesses (small and large), other major considerations during the sale, how an accurate price is determined, and how to maximize acquisition value.

Current Market Conditions for Selling a Business

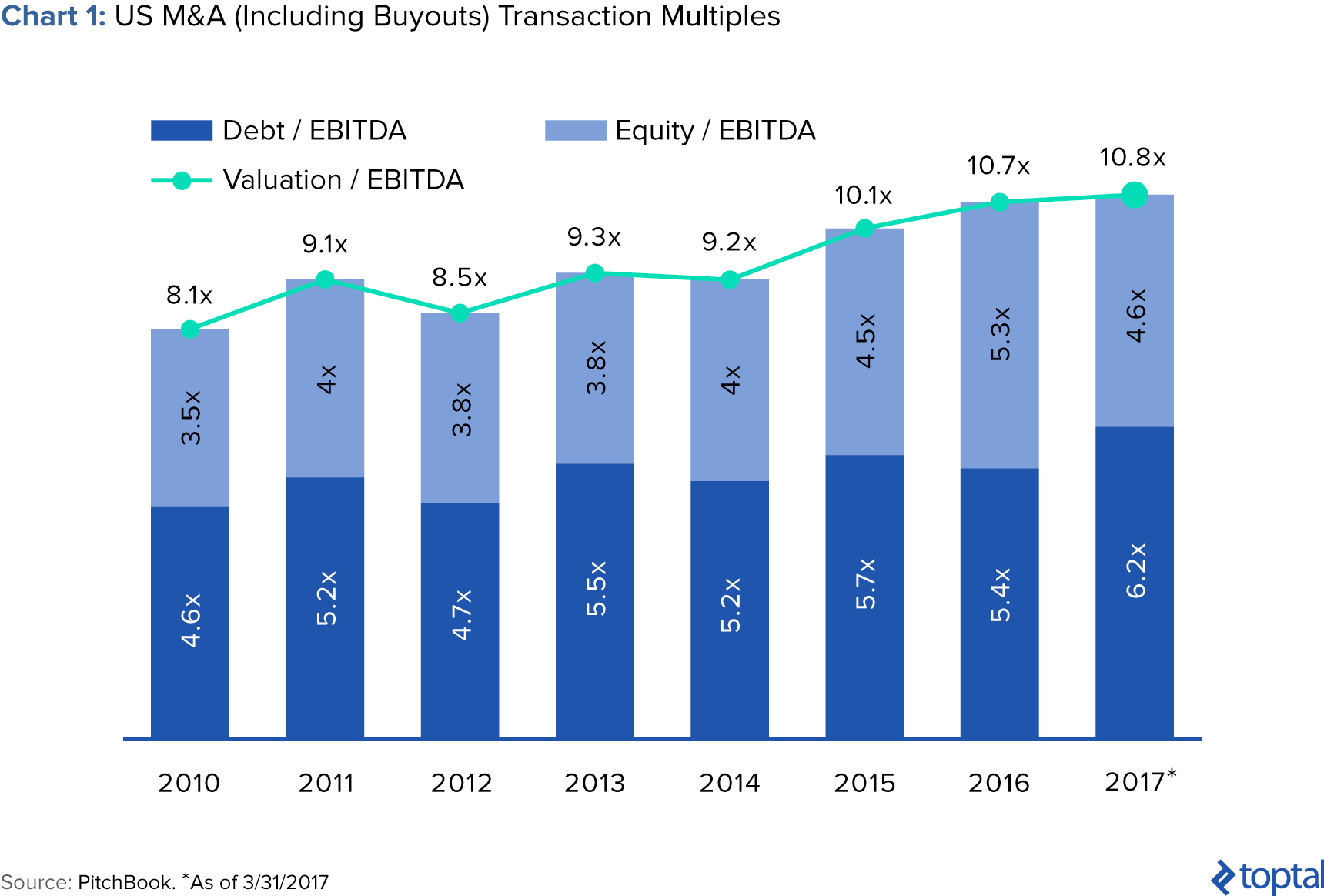

Currently, with acquisition multiples at a record high, market conditions are optimal for selling a business. According to PitchBook, the median EV/EBITDA multiple hit 10.8x in 1Q 2017, a significant difference from the 8.1x multiple in 2010.

The following factors have converged to create a robust market for acquisitions with high acquisition multiples:

Record “Dry Powder” Held by Private Equity Firms

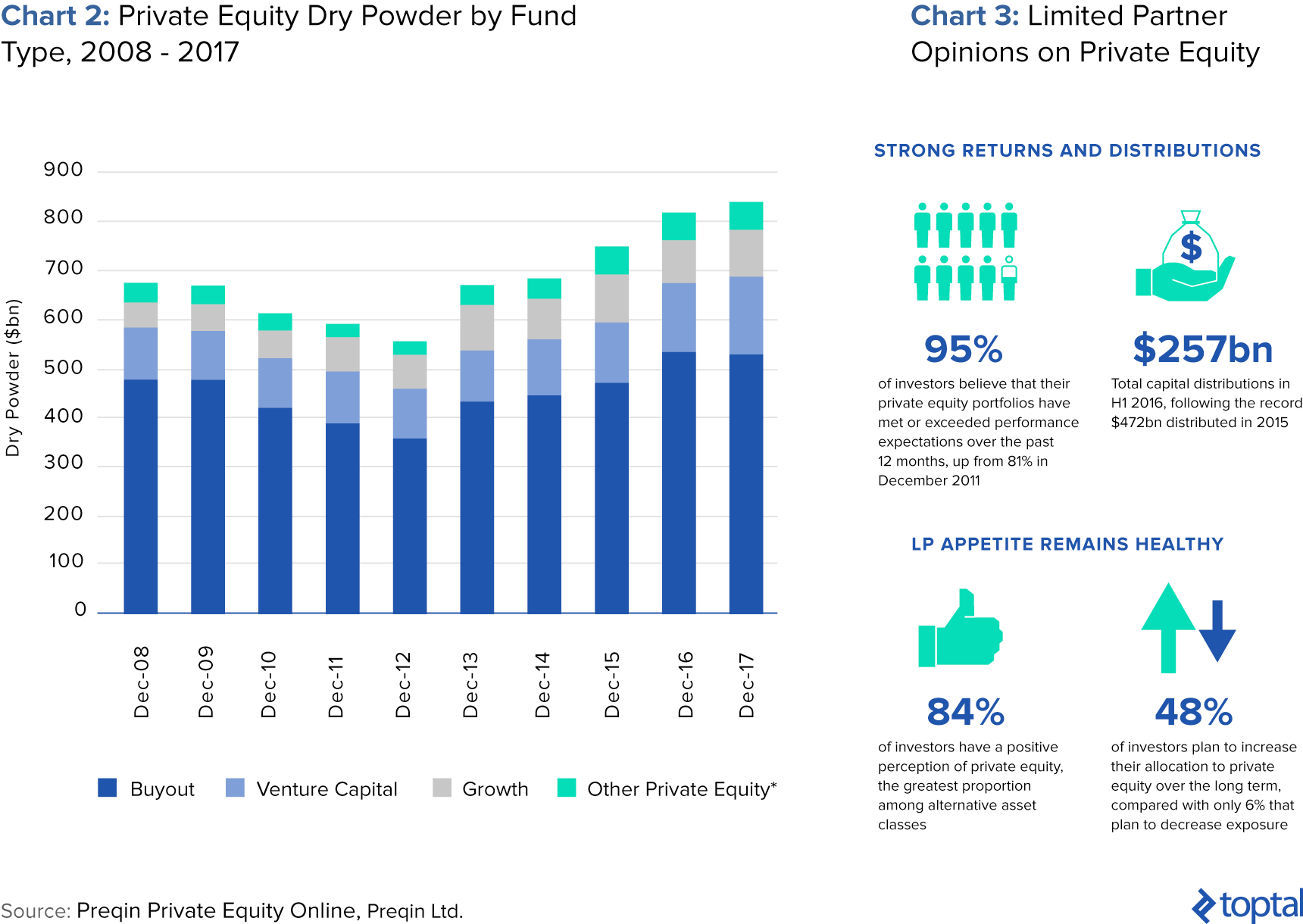

Research company Preqin reports dry powder for private equity buyout funds of $530 billion at the end of 1Q2017, a significant increase from the recent low of approximately $350 billion at the end of 2012. Further, new fundraising by private equity fund managers shows no signs of slowing. In the early part of 2017, Apollo was seeking $20 billion for a new fund, and KKR had raised $13.9 billion for its new fund.

Strategic Corporate Buyers are Holding Record Amounts of Cash

According to Factset, US corporations held $1.54 trillion in cash reserves as of the end of 3Q2016, the highest total in at least ten years, and a dramatic increase from the $700+ billion figure reported in 2007. Of this, much is held overseas, and if repatriated, a portion may be used for acquisitions.

For a strategic buyer, acquisitions can deploy cash reserves and generate returns in excess of corporate treasury bank accounts and investments. Corporations also seek acquisitions that create operating efficiencies or bolster their position in consolidating industries. Consequently, strategic buyers often pay a premium for acquisitions compared to financial buyers such as private equity firms.

Low Interest Rate Environment

Those interested in selling a business benefit from low interest rates, as they directly affect acquisition prices. Duff & Phelps, which publishes a widely-used study of the cost of equity capital, incorporates the ten-year trailing rate on the 20-year Treasury bond in its benchmark figure. The 3.5% figure reflects the low yields of the last ten years. Duff & Phelps’ comparable rate at the end of 2008 was 4.5%. At the same time, the equity risk premium also decreased, from 6.0% to 5.5%.

High Prices for Publicly-traded Equities

Business values are often determined with reference to public equities, and with the S&P 500 and NASDAQ at or near record levels, those looking to sell a business benefit from a comparable increase in prices.

All of these factors have led to an acquisition market ideal for selling a business. Large acquisitions have recently been made for eye-popping prices. Over the past year:

- JAB Holding Company offered to acquire Panera Bread for $7.5 billion, approximately 19.5x Panera’s EBITDA according to Nation’s Restaurant News.

- Private equity owned Petsmart acquired pet product site Chewy in the largest acquisition of a VC-backed internet retailer. Chewy is one of the fastest-growing eCommerce retailers on the planet.

- Unilever acquired Dollar Shave Club in 2016 for $1 billion, paying 6.67x 2015 sales and 5x projected 2016 sales.

Despite these favorable conditions, selling a business still requires advance planning and thought. Numerous factors can positively or negatively affect the value of your business. Addressing these issues early can be beneficial when it comes time to sell.

How Long Does Selling a Business Take?

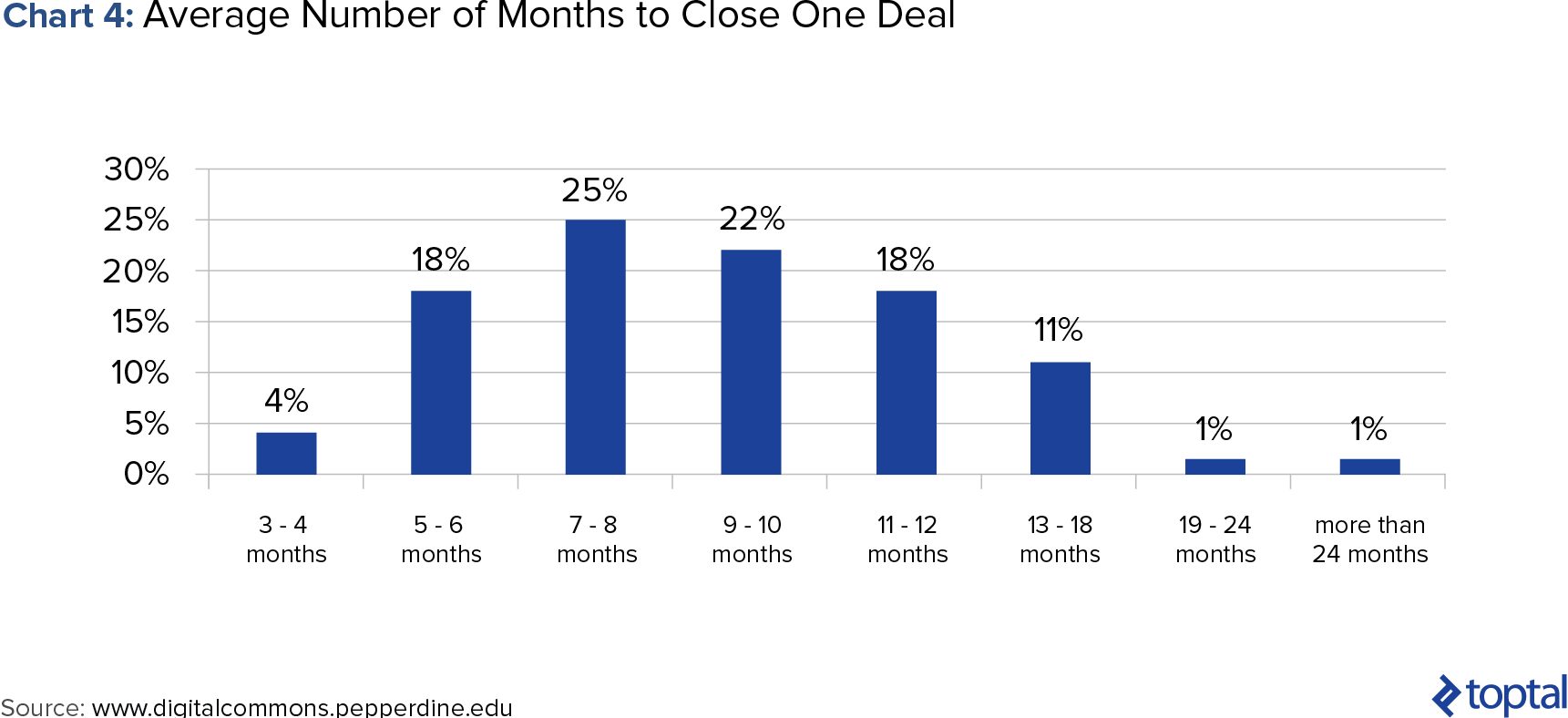

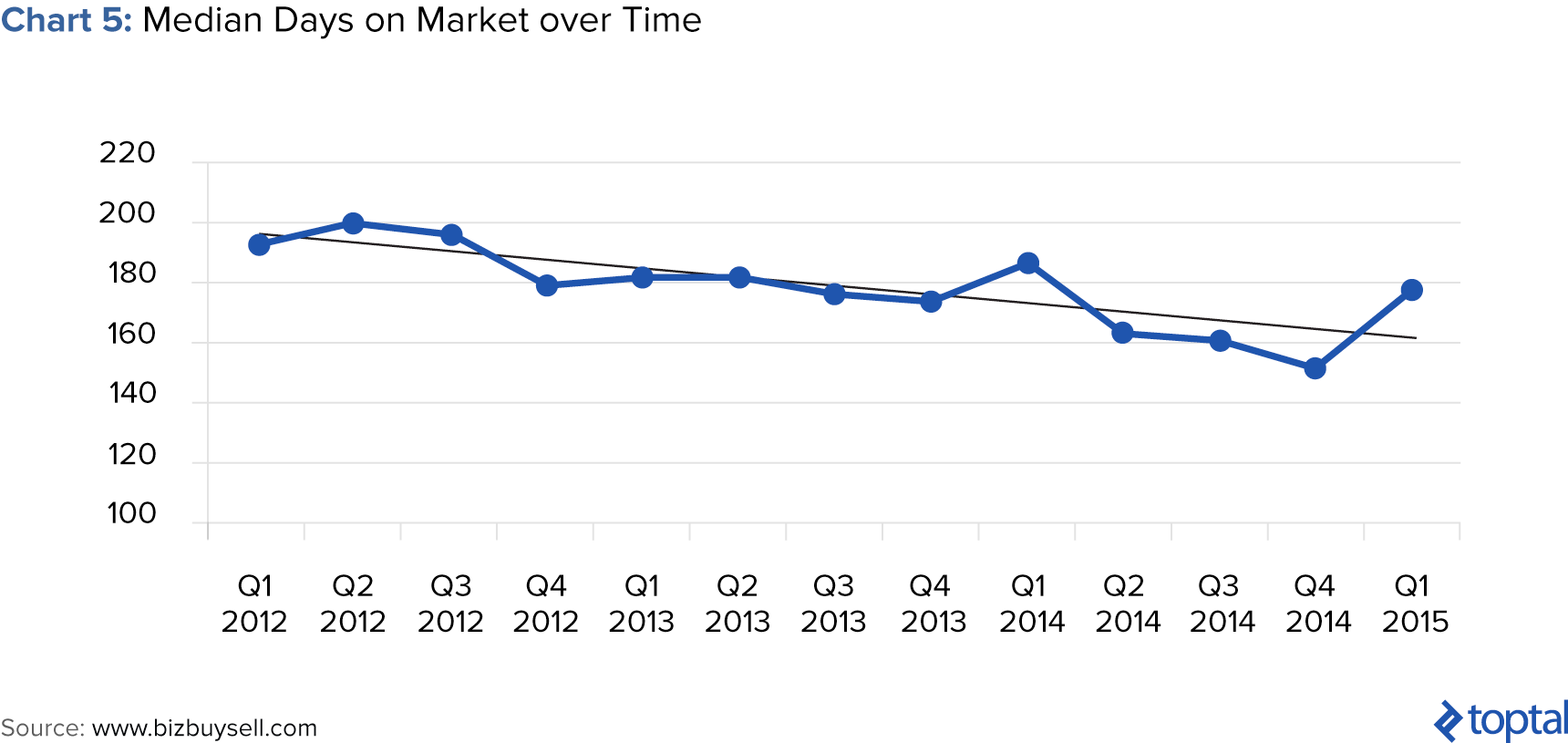

The duration of the sale process varies. One determining factor is the size of your company. As of the end of 2016, the median time a small business was on the market was a little over 5 months (160 days), down from a peak of 200 days in mid-2012. For larger companies, the sale process can take between 5 and 12 months, as indicated below.

As a business valuation expert, my experience is much the same. The owner of a larger business is more likely to employ a M&A advisor to sell the business, and the advisor is more likely to conduct an auction process to maximize the business value. In addition, as the business becomes more complex, the involvement of more people can lengthen the due diligence process. I have led due diligence teams in large acquisitions where we regularly conducted meetings with as many as fifteen people, including specialists from various departments. Inevitably, inboxes became crowded and the frequency of meetings increased. It became more difficult to ensure that everybody involved was on the same page.

The time it takes to sell your business is also based on the dynamic balance of business sellers and business buyers in the market. The importance of this is particularly pronounced in the small business acquisition market, as seen in the chart below. In 2012, fewer buyers had the resources to buy a business, and acquisition financing from banks and other lenders was still negatively affected by the 2008 financial crisis. As the number of buyers and availability of financing increased, the demand by buyers increased, and median time to sell a business decreased.

Considerations in Determining When to Sell Your Business

Your Motivations for Selling

In general, the value of a business is equal to the sum of all expected future cash flows. When the value of the offer is greater than your projected future value of the firm, it’s time to sell.

“Value” can have many meanings. For one, the business may hold financial or strategic value that makes it compelling to an acquirer. Alternately, the business owner may have other financial uses for the sale proceeds—if the return on the alternative investment is higher than on the business, it’s also time to sell.

However, there can be non-financial motivations for selling a business. I frequently see business owners who have spent a significant portion of their lives building a business and are simply ready to move on to the next venture. Others sell for lifestyle reasons: a former client sold several businesses over 20+ years to fund his travels around the world. Had he agreed to stay with these companies post-sale, he would have received higher valuations. Still, the flexibility to travel and pursue adventures remained his priority.

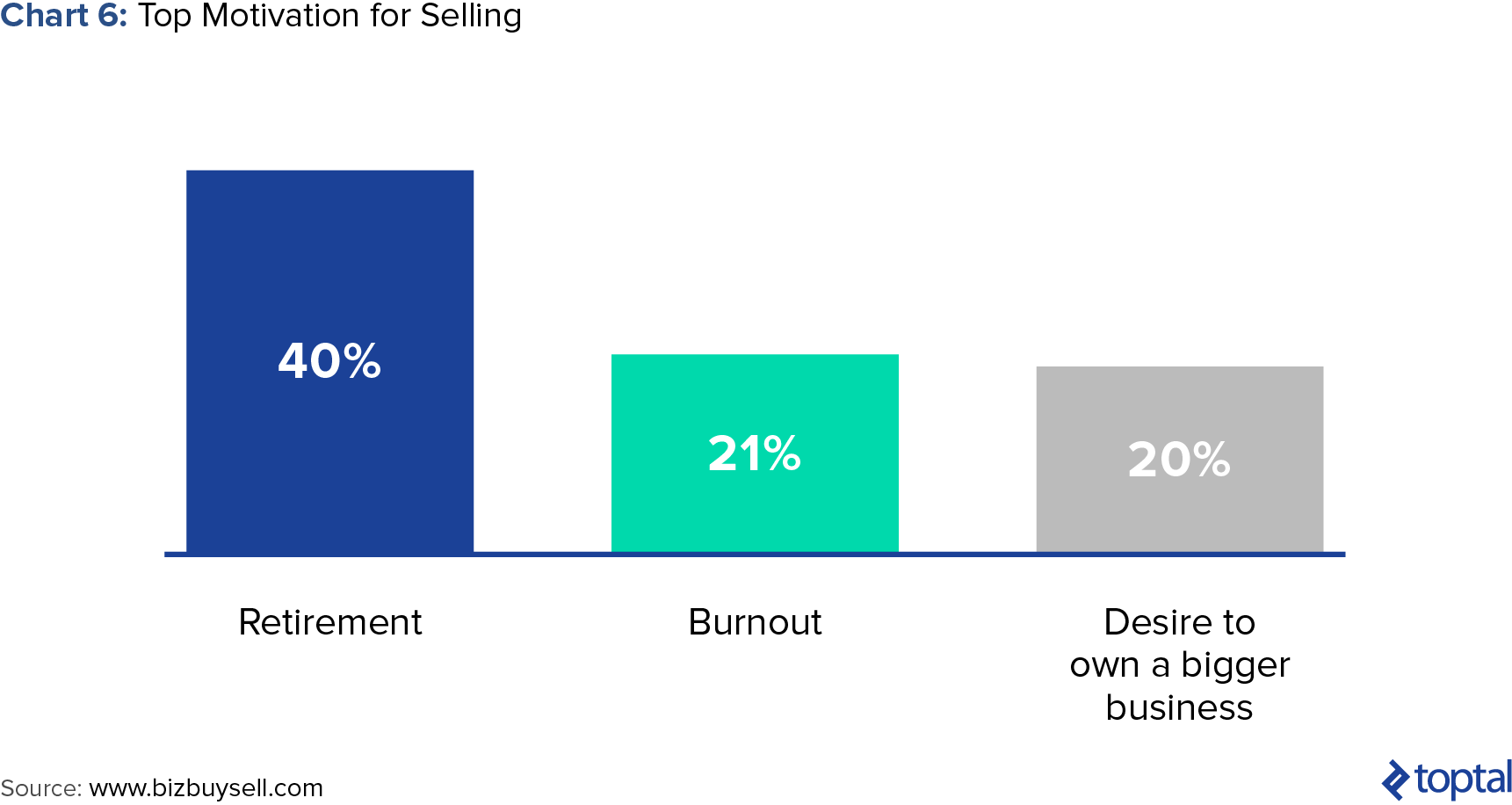

This is consistent with seller surveys. According to a 2016 survey, the top motivation for small business owners to sell their businesses was retirement (40%), followed by burnout (21%) and the desire to own a bigger business (20%).

Business Growth

Above all else, a buyer wants assurance that the cash flows paid for will be realized after the sale. Selling a business will be easier, and the value received by shareholders maximized, if the business is growing and profitable. The ideal time at which to sell a business is when cash flow, growth, and consequent valuations are going to peak. When a seller or buyer anticipates a decline in the rate of growth, it could result in a significant drop in value. As you might expect, this is not a recommended time to pursue a sale.

The importance of growth to business value and sale timing can be illustrated by the Constant (Gordon) Dividend Growth Model: Value of the Stock = Dividend / (Required Rate of Return – Expected Dividend Growth Rate)

Let’s apply this formula to an example. If a business pays $1 million in dividends, and the required rate of return is 13.5%, a business that has no dividend growth, all other factors held constant, would be worth approximately $7.4 million. On the other hand, if the same business is expected to grow 1% per year, the value increases to $8 million. For a company that does not pay dividends, the same principle can be applied to cash flow. In this example, each percent increase in expected growth leads to an 8% increase in value.

Tax Considerations

Just as the legal form of business at a business’ inception is determined by tax considerations, when it comes time to sell a business, the choice among a merger, sale of stock, or sale of assets should also factor in tax implications.

For example, a sale of assets will likely result in capital gain or loss treatment, whereas an employment agreement results in ordinary income and is taxed at a higher rate. Even in a sale of assets, you should allocate the purchase price among assets in a tax-efficient manner. An allocation to inventory or short-lived assets will typically result in more favorable tax treatment than an allocation to real property or goodwill.

Even expectations of a change in the US tax laws can impact the sale of businesses. If the current presidential administration were likely to simplify the tax code and decrease the capital gains tax rate, business owners would likely wait to sell. When I’ve experienced cases such as these, the running joke among M&A professionals was that business sellers would likely live on artificial life support in order to survive into the new tax year and reap higher net proceeds.

Buyer Motivations

The market for acquisitions is dynamic. An owner or manager seeking to sell a business should be aware of industry-specific developments and direct their selling efforts to leverage those trends.

In my acquisitions work for an insurance company, our growth strategy was to acquire companies in markets that were overseas and less competitive. We also focused on acquisitions that would add internet sales to our existing team of insurance agents. Some of our competitors were seeking similar acquisitions. Business owners aware of those industry dynamics were able to develop a business sale strategy based on these dynamics, maximizing shareholder value.

Here are additional examples of industry-specific strategies:

- A fast-growing business in a slow-growth industry should focus on strategic buyers seeking high growth. In May 2016, food company Hormel paid $286 million for Justin’s, a fast-growing producer of organic nut butters.

- Companies with a younger customer base can be good acquisitions for established companies in the same space. Wal-Mart recently sought to expand its customer base to younger consumers by spending $200 million on eCommerce startups with direct-to-consumer models, including Jet.com, Moosejaw, Shoebuy, and ModCloth.

- For private equity buyers, businesses that lead to increased sales, lowered overhead, and increased gross margins continue to be attractive. These buyers are attracted to assets with considerable scope for optimization and efficiency enhancements.

- For strategic buyers, decisions about capital investments are often made by comparing build vs. buy options. A business that enables a strategic buyer to reach its financial or strategic goals will always have a pool of potential acquirers.

The Value of Advisors

In selling a business, you may be tempted to cut costs and undertake the task alone. However, the utilization of experienced M&A lawyers is always advisable, as contracts allocate the risk of the transaction between parties, and often contain detailed financial terms. Retaining an M&A advisor can also lead to a higher price for the sale of a business. Additional advisors such as accountants or technology and human resource specialists can also add value in specific situations.

As a financial consultant, I worked with a business owner who initially attempted to sell his business on his own by generating his own list of competitors and other potential buyers. After failing, he assembled a team of lawyers and M&A advisors late in the process. Ultimately, this unsuccessful sales attempt tarnished the sale process and raised questions about the value of the business, ultimately leading to a 25% lower sale price. In addition, the owner, who was originally interested in remaining with the business post-sale, was forced to sell to a financial buyer with a different strategic vision. He was soon forced out of the company. Though this was an extreme case, I cannot overstate the importance of building out an experienced team of advisors.

Financial Intermediaries

The two types of financial intermediaries include a) M&A advisors, and b) business brokers.

Business brokers are generally involved in the sale of smaller firms (typically with values of under $5 million). Many business brokers list businesses for sale in an online database with basic information but do not proactively call potential acquirers. With transactions of this size, the broker faces more difficulty “fully marketing” the transaction and contacting a large number of potential strategic and financial buyers. Compared to business brokers, M&A advisors handle larger transactions and engage in more pre-transaction business planning. They also contact a wider variety and larger number of potential buyers.

The Benefits of Using a Financial Intermediary Include:

- Reduced time and attention necessary from the business owner. The process of selling a business can often last between six and twelve months. Most business owners don’t have the time or ability to supervise each stage of the process without diverting needed attention away from current business operations.

- Buffer between buyer and seller. This is especially important in situations where the seller of the business is seeking to keep its plans confidential; an intermediary can solicit interest on a “no-names” basis.

- A level playing field between novice sellers and experienced buyers. Especially with financial buyers or active strategic buyers, the difference in knowledge of the acquisition process can be vast. Private equity buyers can buy dozens of businesses each year, and the most active strategic buyers, such as Google, can acquire 10+ companies in a year. A business owner selling a business will have trouble competing in knowledge.

- Network of potential buyers and knowledge of marketing pitches. An experienced financial intermediary with a strong network and marketing knowledge is well-positioned to generate interest in your business. If successful, the price at which you can sell your business will be enhanced by creating competition among buyers in an auction process.

- Experience with the due diligence process and legal documentation. The due diligence process whereby buyers examine the books and records of the business being sold, can be too time-consuming and complex a task for business owners to undertake themselves. In addition, experienced financial intermediaries help create a transaction structure and collaborate with attorneys on legal documentation.

The Drawbacks of Using a Financial Intermediary Include:

Price

Financial intermediaries can either charge a fixed transaction fee, a retainer, or both. The business seller will also be responsible for the expenses of the intermediary.

- Business broker fees are generally in the range of 10% of the acquisition price. They typically do not charge a retainer, and fees are only paid upon the sale of the business.

- Fees for M&A advisors vary more widely. The fixed transaction fee for selling a business generally starts in the $40-60,000 range, and many advisors base their “success fees” on the “Double Lehman” formula: 10% of first $1 million of transaction value, 8% of second $1 million, 6% of the third $1 million, 4% of the fourth $1 million, and 2% of everything above that. According to a 2016 survey, typical middle market transaction fees were as follows (based on percentage of transaction value):

- $10 million 3.5% – 5%

- $50 million 2% – 3%

- $100 million 1% – 1.5%

- $250 million 0.75% – 1%

You should align your incentives with those of the intermediary. If an advisor’s retainer is disproportionately high, their incentive to complete a deal is lessened. In these cases, the business owner should resist fee arrangements that include a relatively large up-front fee. On the other hand, if the “success fee” is disproportionately high and the advisor only receives significant compensation upon a sale, it creates an incentive for the advisor to complete a deal—even a bad one.

Disclosure of sensitive information

An M&A advisor may contact hundreds of potential buyers and circulate confidential business information in an effort to create a robust auction and maximize business value. The mere disclosure that the business owner is considering a sale can significantly impact customers, competitors, and employees. An experienced advisor can limit the risk of confidential information being disclosed.

Independent Valuation Experts

Retaining an independent valuation expert can maximize value, especially when used in conjunction with an M&A advisor. With a large percentage of M&A advisor fees being paid only if a transaction closes, the M&A advisor experiences an inherent conflict of interest. That is, a business cheaply valued will sell more quickly than one that is fully valued. An independent valuation expert provides the business owner with a second opinion and a market check.

As with employing a financial intermediary, the downside of retaining an independent business valuation expert is price. They can also lengthen the sale process. For many businesses, an appraisal can cost between $3,000 and $40,000 and take 4-6 weeks, although more cost-effective options are available for smaller companies. Valuations of larger or more complicated business can take months and be far more costly.

Legal Advisors

The involvement of experienced merger and acquisition lawyers is critical. After all, structuring a business sale transaction and negotiating the documents are exercises in risk allocation. These documents ensure that the seller will receive the full amount owed to them and will have limited liability post-sale, while also ensuring that buyers receive the value from the acquisition.

To counter typical buyer protection provisions such as representations and warranties or noncompetition and nonsolicitation agreements, experienced legal advisors can help you obtain favorable terms and secure protections for you. This is especially important if you are selling to a business of much larger size, which would inherently have more negotiating power.

Determining the Right Price

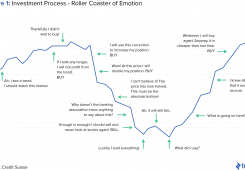

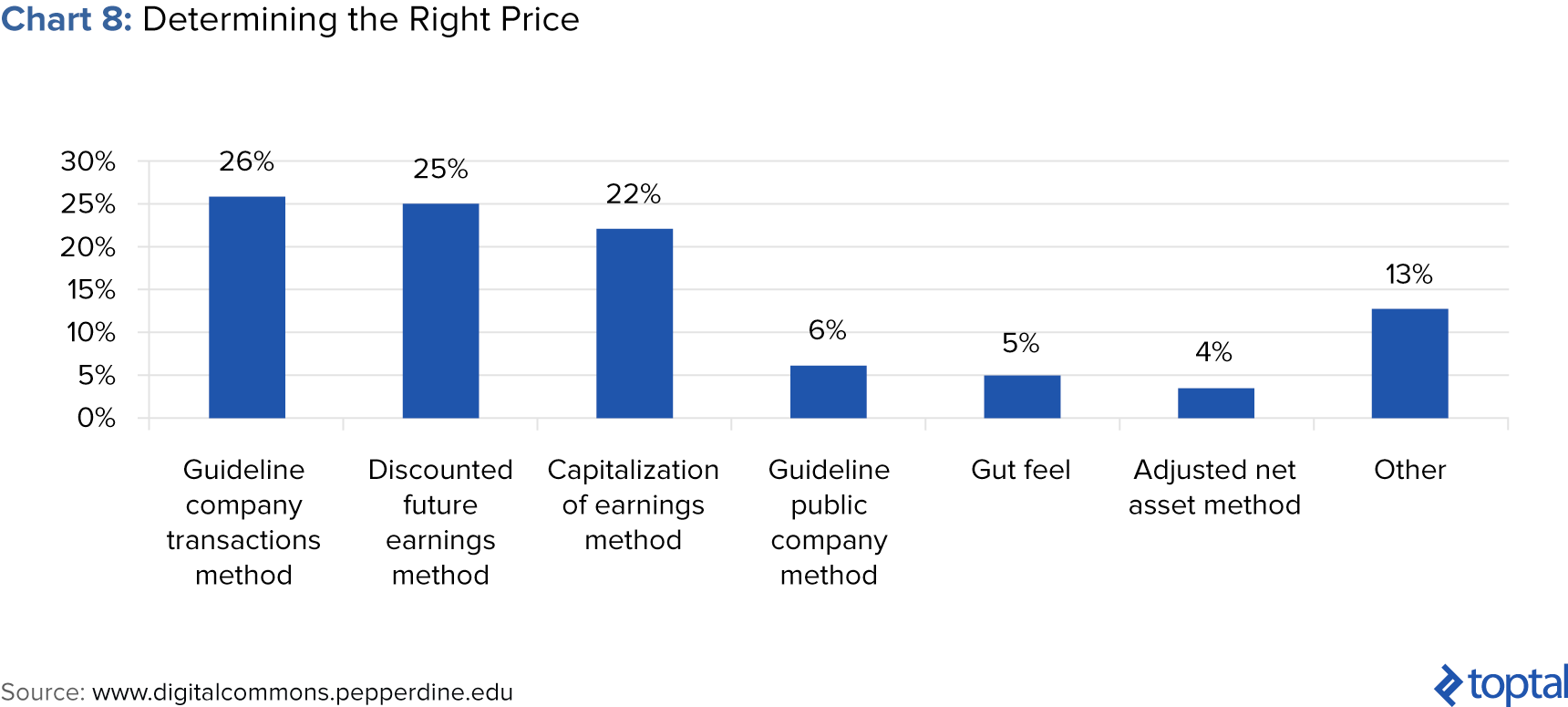

Over the years, I’ve come to find that business valuation is as much art as science, as evidenced by the fact that 27% of business sale transactions don’t close. Of those that don’t close, 30% fail because of a gap in valuation. However, experts generally agree that there are three primary methods of business valuation: discounted cash flow, market multiples, and asset valuation.

While all of these methods can prove useful in the right situation, valuing earnings or cash flow will generally provide a more accurate view of the value of the business being sold. Even better, a business owner selling a business knows of an identical business that has been recently sold and knows the price that it has been sold at.

Discounted Cash Flow and Capitalization of Earnings Methods

Absent a recent comparable business sale for benchmarking, discounted cash flow or capitalization of earnings valuation methods can be utilized. On one hand, discounted cash flow models are typically used to model growing businesses, and they estimate pro forma projected cash flows for a reasonable period into the future. These are then discounted back to the present using a market-derived discount rate. Capitalization of earnings models, on the other hand, are used for businesses where future growth is difficult to estimate. This method’s valuations take pro forma earnings and divide them by a capitalization rate.

The pro formas are adjusted for unusual or nonrecurring events and are intended to normalize the numbers. For example, with private companies, it’s not uncommon for executive compensation to vary from industry standards. The model should be adjusted to reflect compensation levels that would be more typical. Similarly, private companies may have contracts with other companies also owned by the owner, and the pro formas should include adjustments if those contracts vary from industry norms.

It is important to note that the appropriate discount rate can be difficult to determine. The discount rate always starts with the “risk-free rate,” a long-term US Treasury bond, and is adjusted upward to take into account the extra risk of buying a business. An equity risk premium is then considered, available from sources such as Duff & Phelps, and may create an additional premium for a smaller company or a company in a more uncertain industry. On top of those adjustments, the discount rate may be adjusted even higher on the basis of “rule of thumb” estimates that the business appraiser believes are appropriate to determine the true risk of the company.

Market Multiples

The starting point for a market multiple valuation is a public company in the same industry. Multiples such as price-to-earnings, price-to-sales, price-to-EBITDA, and price-to-book are widely available from sources such as Bloomberg and Google Finance. The multiples for the public companies are then applied to the appropriate data for the business being valued. Adjustments to the resulting number are then applied to account for the difference in liquidity between publicly traded stock, which can be sold easily, and a controlling interest in a company, especially if it’s privately held.

Though high public comparables are great for owners selling their business, they may not reflect the actual value of the company. This is because the prices for public stocks are strongly influenced by general stock market sentiment and investor enthusiasm for sectors that are currently in favor. For example, a technology company will currently have higher market multiples than companies with similar business prospects because of keen investor interest in stocks in the technology sector. In addition, business valuation experts relying on market multiples often find it difficult to develop an appropriate group of public companies. A business valuation that starts with a broad group of comparable companies may not truly reflect the value of the company being sold.

Asset Valuation

The asset valuation method of valuing a company being sold is generally limited to holding companies or asset-rich companies since the value of a business’ assets have little to do with the company’s future cash flow generation. In the case of a holding company, the value of the company is made up of a collection of other corporations or equity or debt investments. Each asset may have its own policy about cash flow distributions to the holding company, so a discounted cash flow valuation is meaningless.

However, exceptions exist with energy or commodity companies. In the case of natural resource companies, cash flow is important, but the value is ultimately determined by the company’s assets underneath the ground. Similarly, a gold company may provide cash to its owners on a regular basis, but its gold is the most important value driver. The price of gold decreasing from $1,850 per ounce in 2011 to $1,200 per ounce in 2017 will outweigh any change in dividend policy by management.

Maximizing Shareholder Value

A significant portion of businesses that are offered for sale eventually don’t sell. As mentioned previously, one of the major causes is the gap between what the owner believes the business is worth and the price the buyer is willing to pay. Oftentimes, this is because an owner has focused too much on business operations, and not done enough to research or plan for its eventual sale. To avoid this issue, implement the following best practices:

Create a Deep Management Team

The common advice for employees is to “make yourself indispensable”—that is, contribute so much that you become irreplaceable by others. However, for business owners, the best course of action is the opposite: you should ensure that the rest of the team can operate without you. Though you may have been the main point of contact with key customers for years, consider delegating and transitioning these relationships to your team. Otherwise, if and when you leave, there is no guarantee that these clients will stay with the company. The risk of losing important sources of revenue or supply can significantly reduce a purchase price or lead to a failed transaction.

Examine and Adjust Operational Efficiencies Strategically

Examine your current business practices and, if necessary, adopt efficient operating procedures before the sale. This may involve investments in new equipment or technology, or it may mean adding or reducing staff. For example, buyers will be less interested in a business that diverts the time of highly-compensated employees towards tasks that can be done more cost-effectively by others.

I have been involved in many transactions where the pro forma financials and resulting purchase price are adjusted to account for needed or excess employees. If a buyer senses a risk that efficiencies and cost savings are not achievable, they will adjust the purchase price downward. Therefore, implementing these measures before a sale reduces can help justify a higher valuation.

Broaden Your Customer Base

For most businesses, sales revenue dictates the majority of its value. Buyers will always examine the business’ customer base and evaluate the risk of customers leaving after the sale. For businesses with a concentrated customer base, the risk of losing of one or two customers can place downward pressure on the purchase price. You should broaden the customer base to reduce reliance on a small number of key customers.

Alternatively, if you are heavily reliant on a single distribution channel, diversifying the distribution of products or services can also help maximize value. Multiple sources of revenue are always going to lead to a higher valuation.

Build Out Robust Financial Reports and Systems

Buyers need to rely on accurate financial statements and systems to assess the financial performance of a business. I’ve seen many large and complex businesses lack robust accounting and financial processes, relying too heavily on basic financial systems. This represents a risk to buyers. Ultimately, if the buyer can’t rely on the seller’s numbers, the buyer will either adjust the purchase price downward or cancel the transaction completely.

Buyers prefer seller financial statements that are audited by a high-quality, independent, auditing firm. Many business owners use local accounting firms when they start their businesses, and stay with them as the business grows. As a result, the numbers may not properly incorporate procedures that would be used by a larger firm specializing in business accounting. The inability to provide comprehensive and professionally-prepared statements to a buyer might reduce the value of the company.

Conclusion

As a business owner, you have undoubtedly devoted a substantial part of your life to building your business. The decision to sell your business can be simultaneously scary and liberating. Richard Branson recently provided an interesting account of his decision to sell Virgin Records:

“Selling Virgin Records was one of the most difficult decisions I’ve ever had to make. But it was also a necessary and calculated risk. I had never even thought about selling Virgin Records. In fact when EMI made their offer of $1 [billion] in 1992 we had just signed the Rolling Stones which was something we’d been trying to do for twenty years. We had begun life as a small start-up, growing on the back of the success of Mike Oldfield’s Tubular Bells. From a tiny start-up, we grew into the biggest independent record label in the world.

But at the time of this offer we were going through expensive litigation in a court case against British Airways (which we eventually won) following their ‘dirty tricks’ campaign. If we had carried on running both companies they both would have closed…[B]y selling Virgin Records we left both companies in strong positions and kept a lot people in their jobs. Both businesses are still thriving today.”

Investing in advance planning for the sale of your business is critical to realizing a return on the resources you have already put into it. It is natural to think that the time to properly position and sell your business is an unnecessary burden. However, this time is crucial for enhancing the sale price and ultimately helping you realize the full value of the business. The combination of the right team and adequate investment of time can be the difference between simply closing up shop and maximizing a source of future wealth.

Like Branson, whether you choose to spend this future wealth on a remote island in the sun or on your next venture, well, that’s up to you!