Hiring a Part-Time CFO: Key Duties of the Strategic CFO Role

Why Hire a Part-Time CFO?

The first reaction to this title would be, why would you just want a part-time CFO – they are a key player in the business? If your business is growing fast, or you have complex accounting projects to implement or even an important fundraising event coming up, a CFO is the obvious solution to look for. Traditionally, this would manifest in the form of a search for a full-time CFO, but at times a temporary one can bring certain strategic advantages. For example, consider the following scenarios:

- First-time CFO: Key hires are critical. Getting them wrong can be costly from a time and financial perspective. A part-time CFO allows the management to dry test the role and see what results it brings and the traits that the role demands

- Firefighting: An experienced outsider can come in and solve a complex issue using earned knowledge from having already solved it in other organizations.

- Caretaker: If there is an interim period where the CFO chair is vacant (gardening leave, maternity leave) an interim can come in and maintain continuity.

- Jolt of ideas: At times, companies can become myopic in their views. Bringing in an outsider for a period can allow for fresh ideas from someone whose goals are very transparent.

- The Closer: If there is a significant funding or exit event approaching, a part-time CFO can lead the business over the line. With timing and bonus related advantages, this can be an excellent way of achieving the desired result

In terms of cost, the median annual CFO salary in the USA is between $406,474 and $639,000 for public and private companies respectively. If a headhunter was used, their total fees can then add approximately $60,000 to the bill. This is not a cheap exercise and, if done poorly, can be expensive and bring hidden costs to the business from inertia. On the other hand, you could hire a seasoned professional as a part-time CFO within a matter of days and at an annual cost of between $156,000 and $208,000. This also comes with the flexibility of no termination fees and the license to roll the contract over on a weekly basis. The position could also change throughout the year, giving the opportunity to bring in specialists to tackle specific problems. Why have a generalist, when you can hire specialists at a third of the cost?

There are four key pillars to the role of the CFO; in this article, we will look at these roles in the context of how an interim CFO may be required and can help. Each section will also detail desirable characteristics that such a role requires.

Accounting

While they will not necessarily be preparing the financial statements, a CFO is the person who has to sign off on them and defend them to management, investors, and regulators. Control is a key element of the role along with ensuring that financial records are presented in a timely, accurate, and informative manner.

The accounting process for a team with a tenured CFO is a well-oiled machine. Controllers and accountants will prepare the finances and the CFO will communicate business decisions down the chain, review the figures, and report them upwards. However, when seeking a part-time CFO, there is likely to be a more hands-on role required of them the accounting process. Perhaps:

- The process is a mess. Cracks may have been papered over before in processes such as reconciliations.

- A modernization process is required with software.

- A more strategic insight is required for the board pack and reporting channels.

- The team needs to be trained for new business units/incorporating acquisitions.

Such a role will require a strong set of project management and delegation skills. An ability to communicate clearly and inspire a potentially jaded/overworked accounting department also cannot be overlooked. When assessing CFOs for this role, pay attention to their most recent roles and the prestige of their last company. A CFO who has worked in a large, traditional organization may not have received enough exposure in recent years to changing accounting technology and may not be able to cope with the stress and flux of an accounting clean-up operation.

Treasury

CFOs also oversee the treasury function of an organization and, depending on the size of the company, they will delegate day-to-day management of it to a treasurer. For that, the main concerns and responsibilities for a CFO are to oversee on a high level the following:

- Risk: FX, interest rates, counterparties, operational risk

- Liquidity: Working capital management and availability of credit lines

- Capital Structure: Asset liability management and balance sheet composition

A strategic CFO will view the balance sheet as a ship that they sail and one that can be powerfully maneuvered to the benefit of the organization. During the Financial Crisis of 2008, balance sheets became the focal point of all businesses. Strategic CFOs were those that were both defensive and proactive to this. They pivoted their capital structures towards longer dated liabilities and shorter dated assets, giving their businesses the breathing space to operate and prepare for future opportunities.

While from an accounting perspective a CFO will need book smarts and project management, on a treasury level, a strong understanding of the financial markets takes over. Prior experience of dealing with financial instruments will ensure that they are privy to the machinations of foreign exchange risk and the suffocation that poor working capital management can enact on new business growth.

The best CFOs are those that sit with a commercial hat on and view their role as as a business generator, not a supporter. If working capital management is poor, a company might be bleeding money away on unnecessary interest payments on borrowing. On the other side of the coin, unnecessarily high cash reserves are a sign of a CFO that doesn’t have creativity or proactivity.

A CFO with a treasury background in banking will be exceptionally strong on the liquidity side, but perhaps not so much on working capital. Conversely, a CFO with a manufacturing background will deviate to the opposite. For that, dependent on the pressing treasury needs in the organization, pay attention to the trained background of the candidate.

Capital Markets

Treasury duties are mostly concerned with cash flow from operations, in terms of cash flow from financing, a far bigger picture is required. Tapping capital markets and managing investors is a role that a CFO must instigate and lead; funding the company with significant capital ranging from small angel rounds, through to IPOs and then institutional bond issuances.

Part-time CFOs are normally hired especially for a role like tapping the capital markets. If the founding team is not experienced in this area, their negotiation power can be boosted by bringing in a skilled operator to lead the process. Again, this demonstrates the value of a part-time CFO, where specialist expertise can be brought in for a specific project. By the time a startup is raising Series A, where a priced round is being negotiated, they must be prepared to ensure that the appropriate funding arrives at a fair valuation. Yet, for early stage companies looking for seed rounds, it is more important to have a CFO that has the creativity to find investors and communicate the long-term vision for the business. Bringing in different part-time CFOs for different stages of fundraising can be strategically critical for startups.

Capital can be raised through debt or equity, from public or private sources. The CFO should be able to clearly inform the management team both when the company should be raising and what type of instrument they need. The previously mentioned areas of accounting and treasury lead into this role, as effective management of those responsibilities will provide perfect insight as to when capital needs to be raised.

While the CEO is an important public figurehead for companies, the CFO also plays an important role communicating the financial side. They are expected to be made available to investors to provide deeper color to the financial statement numbers. Being able to communicate a vision for the the company based on numbers, not rhetoric, is important. When assessing candidates for this role, pay attention to their confidence and communication skills.

Business Strategy

Effective CFOs provide a different perspective in both the boardroom and on the business front line. They can be the voice of reason that drive revenue growth through margin expansion, pointing out cost savings and maintaining the cadence between making sales and making profits.

A CFO will have no particular bias to a certain business line, geography, or customer. Their metric is the financial stability and health of the company and for that, they can be a crucial form of impartial advice at a strategic level. The viewpoint of a CFO can be more long-term than other divisional heads, because their responsibilities stretch that far, for example: “can our debt be paid off in ten year’s time?”

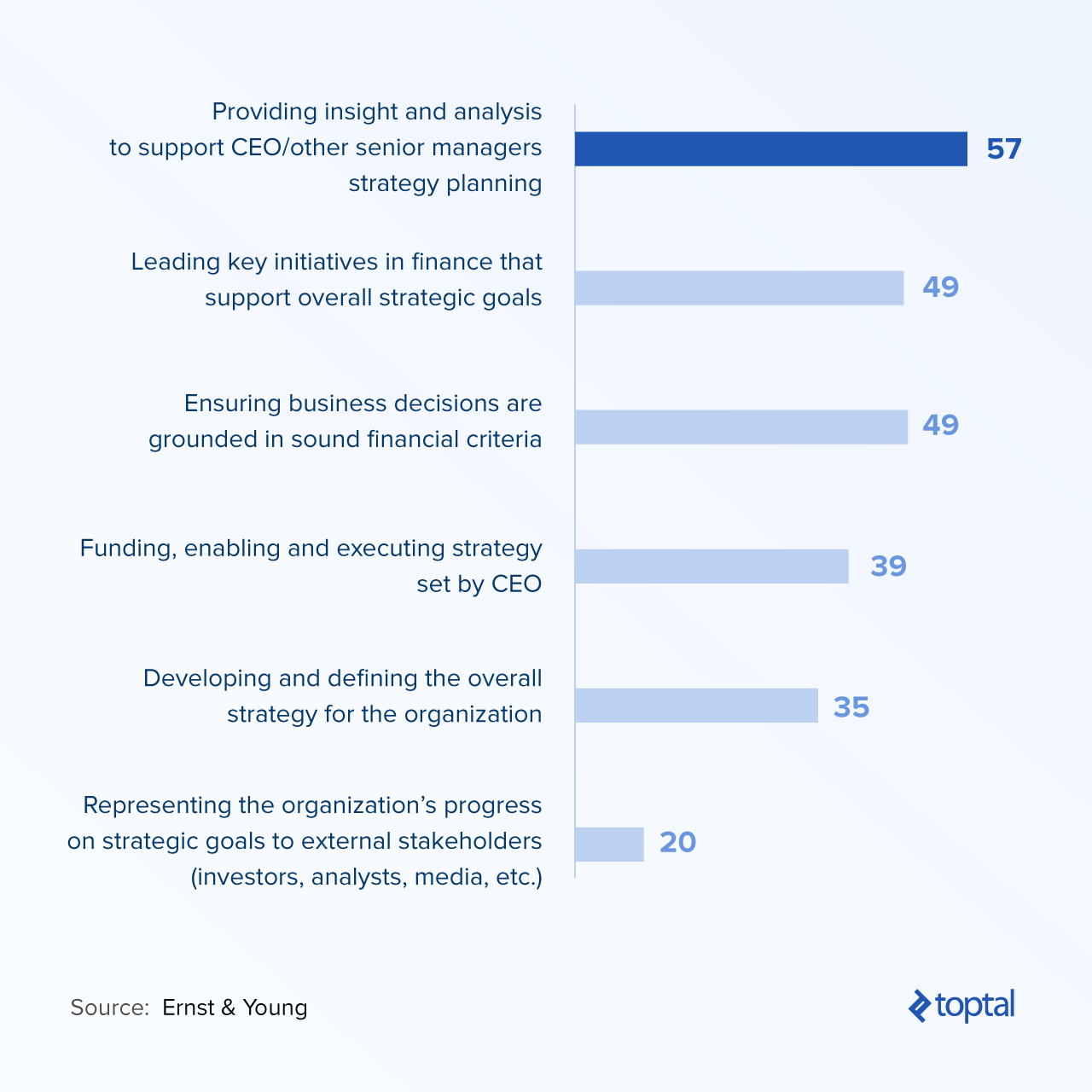

Candidates that have a diverse mix of operating and financial roles throughout their career demonstrate these traits. Especially someone that has worked in sales or product development, where they can then marry the needs of the revenue generators with the support staff. According to Ernst & Young, when CFOs were asked to asses their input to strategy, the majority of respondents say that their most valuable input is across all strategy, as opposed to specifically within the realms of financial guidance:

When interviewing part-time CFOs, you need to find someone that can grasp the business quickly and hit the ground running. Ask them questions related to your business, pose a commercial problem to them, and see how they respond. A confident and well-rounded CFO will relish this opportunity and will not shy away from it.