Experts’ Corner is a series of articles sharing practical tips and solutions that our experts have gained over years of on-the-job experience. It aims to elevate our readers’ day-to-day execution and performance.

Fundraising, for companies at any stage, is undoubtedly a challenging process. According to a recent study, an average series seed raise requires contact with 58 investors, 40 investor meetings and over 12 weeks to close a round. Even for seasoned entrepreneurs and startups already with market traction, a compelling pitch and accompanying pitch deck are still necessary. Despite variance around stylistic delivery and aesthetics, you might be relieved to hear that the infamous pitch deck boils down to a formula. In fact, there are a number of topics and slides that investors actually expect—all of which will be discussed in this article.

The following piece is meant to serve as a guide for creating effective, successful investor decks. It focuses on the creation of the deck itself, instead of the delivery of the pitch. While there is no ultimate one-size-fits-all format for investor decks, we will share a set of widely-accepted guidelines along with corresponding pitch deck examples.

Pitch Deck Best Practices

Treat your pitch like a story

Weave a compelling narrative about a problem in the world, what the inevitable solution is, how your product is that solution, and why your company will succeed. Your story should lead to your product being the logical response to the problem you’ve identified. Rather than adding bells and whistles, focus on crafting a story that is both streamlined and coherent. Be passionate. Make it personal.

This task can sometimes prove tricky for founders who have lived and breathed their business for months or years. Take a step back and imagine that you were learning about your business for the first time. As venture capitalist Tomasz Tunguz suggests, “The most successful pitches argue the market will unfold inexorably in the way the founders envision on a relevant time scale. And, that this startup in particular will dominate share in that new world. There is no prescriptive way I can recommend to consistently argue inevitability. Some founders use data. Others use logic. Still others use emotion and passion to do it. But in the end, these exceptional storytellers make you want to believe, suspend doubt, and disregard the great risks that all startups face all along their journey, and get involved with the business.” If you need a bit of inspiration, you can borrow from the famous Hero’s Journey narrative.

In the below example from marketing software company SEOmoz founders Rand Fishkin and his mother Gillian Muessig were not shy about sharing their trials and tribulations. In their opening, they position their story as “How a tiny Mom + Son consultancy became the world leader in SEO software.” Being open and utilizing a timeline makes their narrative something people can understand and root for.

Continually refresh your pitch deck

According to Finance Expert Jeff Fidelman, who has executed over $500 million in transactions across industries, “A pitch deck should be viewed as a dynamic, living document that evolves over time.” As an entrepreneur continues to pitch multiple audiences, they will notice that they are often asked the same questions time and time again. They should take note of these questions, incorporating and addressing them in the presentation.

In addition, the market data and company traction data (e.g., number of users, traffic to your website, sales numbers) should also be continually updated. You never want your data to seem outdated, as you want to minimize the opportunities to call into question your knowledge or credibility.

Understand the context

Understand and evaluate the context in which your audience will be reading or listening to your pitch. How far along are you in conversations with them? Are they familiar with you and your company already? Are they familiar with the market and technology in question? You should even consider whether investors will be reviewing the deck in soft copy form or in-person with a printed copy.

Toptal Finance Expert Kelly Sickles, who raised $100 million for Boxed’s Series C, explains, “Make several decks. Except for the lucky few, pitching is a process more akin to dating than an arranged marriage: You may have to share a deck with investors that you’ve never met. The goal of that deck is to simply entice them to take a meeting. Once interested, you’ll need a deck for your initial meeting. The goal of that deck is to enable a meaningful conversation about your business and your roadmap – again, not to overshare details so that the investors stare at a PowerPoint throughout the meeting.”

Anticipate potential questions and incorporate answers into the deck

An oft-overlooked step in the pitch deck creation is the anticipation of investor questions. You must critically examine your company and your presentation to identify the potential gaps. Instead of being caught off-guard by the investor, think about what investors might ask and create supplemental slides to provide visual support for your answers. If you are delivering an in-person pitch, it could even be helpful to include these supplemental slides in the appendix section of the investor deck.

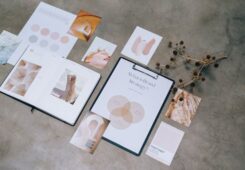

Keep the aesthetic polished and consistent

The pitch deck should be aesthetically pleasing and professional—this can help form an investor’s first impression of you and your company. You can simply use the colors and design from your product as a theme. Or, it can be beneficial to hire a professional for the deck design. In any case, the pitch deck should reflect your company’s personality and align with the branding on your site and product.

In designing the investor pitch deck, keep in mind that not all investors have the same goals and investment approach. Toptal Finance Expert Zachary Elfman, who has served as a buy-side advisor for a multimillion dollar Series A funding round, underscores the importance of this: “If you are pitching a young investor new to VC, maybe having cashed out after selling their own startup, a racier or trendier look and feel might be appropriate. Whereas with more veteran investors, a more to-the-point presentation would provide more credibility. Stay high-level and avoid pictures, small print, and any font that has been invented in the past decade with these investors who have seen both sides of the cycle. There are surely a lot of gimmicky decks flying around at this very moment that more seasoned investors are tossing immediately into the wastebasket. DOA.”

In the below investor pitch deck from Tealet, an online farmers’ market for tea, the aesthetic matches their product and website. It’s also clean and easy to read.

Pitch Deck Mistakes to Avoid

Don’t make it too long; 15-20 slides should suffice

Investors are people too. This means that they have limited attention spans. According to the aforementioned study, VCs spent an average of three minutes and 44 seconds reviewing soft copies of series seed raise pitch decks. Continually remind yourself that you are building a pitch deck, not a comprehensive business plan. Include the necessary and most compelling components; don’t try to cram all the details in. If you are overly ambitious, chances are that the excessive information will divert attention away from the story you’re trying to communicate. Should you need to include more information such as growth details, complex technical explanations or financials, opt for creating separate documents.

Finance Expert Aleksey Krylov, who has advised over 50 clients on raising a collective $1.6 billion, suggests abiding by the acronym KISS: “Keep it simple and short. I advise my clients to keep their decks under 15 slides and move non-essential details to the appendix. Investors review numerous pitch decks and business plans a day. All else equal, shorter pitch decks are likely to produce a more positive response from investors.”

Don’t include too much information or text on a slide

Similar to the preceding point, investors won’t have the time or energy to actually read the fine print or all the extra details on the slides. You’ll want to focus on communicating a few key takeaways per slide, making it as easy as possible for your audience to understand and remember these points.

In addition, be sure to include relevant graphs, charts, images, or other media. Utilizing supplemental visuals can be a powerful tool for reinforcing or communicating your message. However, be judicious when deciding which to add; each visual should add real value.

Don’t use overly-complicated jargon

Even if your product is particularly technical or detailed, don’t fall into this common trap. Be exceedingly clear about how you present your company and your story, and be willing to simplify. If you pitch your product as a “B2C scalable cloud-based social media platform for the next gen,” it’ll remain unclear whether it’s a website, an app, and what exactly it does. If the jargon would annoy a tech journalist, it probably won’t impress investors either.

Don’t belittle your competition

While acknowledging your company’s position relative to your competition is necessary, as we’ll discuss in the upcoming section, it’s important not to underestimate or belittle your competition. This could backfire, reflect poorly on you, or potentially be off-putting for investors.

Imperative Slides to Include

The following section will detail the topics that investors will expect and look for in pitch decks. Still, there is some flexibility in terms of topic ordering, as long as you are crafting the narrative in a logical manner.

Company Overview

The Company Overview slide, which can serve as the opening of the deck, should set the stage for investors so they have an idea of what’s to come. It should include a handful of points (between three to eight) about what problem your product solves, background on the management team, and any key traction that your company has seen. The information you include on this slide should be straightforward, exciting, and easily understandable. You don’t want to confuse anybody or get them stuck early on in the deck.

Below is an example from social news, media and entertainment company Buzzfeed. In just six bullets, the slide includes key highlights communicating traction, press, headcount, and high-level financial information.

Company Mission, Vision, or Purpose

This slide is meant to convey your company’s ultimate goals, whether you choose to include its purpose, mission, or vision. According to Harvard Business School, here’s how to define these terms:

- Mission statement: Describes what business the organization is in both now and in the future. Its aim is to provide focus for an organization’s employees.

Example: The mission for a consulting firm could be, “We’re in the business of providing high-standard assistance on performance assessment for middle to senior managers in medium to large firms in the finance industry.”

- Vision statement: Says what the organization wishes to be like, and takes the thinking beyond day-to-day activity in a memorable way.

Example: Ericsson’s (a global provider of communications equipment, software, and services): “the prime driver in an all-communicating world.”

- Purpose: Summarizes what the company is doing for its customers, connecting “the heart with the head.” Greg Ellis, former CEO and managing director of REA Group, refers to his company’s purpose as its “philosophical heartbeat.”

Example: Insurance company IAG: “To help people manage risk and recover from the hardship of unexpected loss”

When describing your business and its goals, aim to convey the originality of your idea. Many entrepreneurs describe their business by utilizing comparisons to other well-known tech companies such as “We are the Airbnb for cooks.” However, this approach is not recommended because it can diminish the uniqueness of your idea. According to Amy Webb, Professor at NYU’s Stern School of Business, “On one site alone—AngelList, where startups can court angel investors and employees—526 companies included “Uber for” in their listings. As a judge for various emerging technology startup competitions, I saw “Uber for” so many times that at some point, I developed perceptual blindness.”

Below is an example of a Company Purpose slide from video-sharing company YouTube:

The Team

Startup investing, particularly for early stage startups, is often focused on human capital. At the end of the day, investors base their decisions on whether they can trust in you, your capabilities, and your persistence.

Given the importance of the team in shaping investors decisions, make sure you highlight both the range of skillsets and the necessary experience that the founding team possesses. Toptal Finance Expert Samir Chaibireinforces this concept: “You can show me that you can execute in two ways: traction and team; a combination of both is, of course, best. I would happily back a founding team of a fashion marketplace that can show me that they know that industry very well, that they have worked with global fashion retailers and brands, and the skills of the team as a whole represent the right mix to take on the industry incumbents. In that case, a mix of experience in eCommerce, operations, and marketing/merchandising would be best. If you are raising your seed round, your team won’t be complete and you will lack some key competencies; your pitch should address that through a detailed hiring plan.”

This slide typically includes images and accompanying titles for each key team member and brief summaries of team members’ educational attainment and prior employment. It also highlights relevant expertise. It should also list out advisors, consultants, and board members, if any.

There’s varying advice around whether to introduce the team earlier or later on in the deck. Finance Expert Grant Blevins, venture capitalist who has has helped raised over $20 million in early stage capital in the past year alone, recommends putting the team early on: “Put Team first, at the very beginning of your slides. Bias investors from the beginning with your credentials. I can tell you some stories of average pitches where I was not that interested in the product until I found out how accomplished and educated the team was.”

Below is an example from content marketing software company Contently. It exhibits the key team members, including images and impressive credentials from each (education and work experience). It also includes other investors, which can stoke the FOMO (fear of missing out). Y Combinator founder Paul Graham talks about this herd mentality in one of his blog posts: “The biggest component in most investors’ opinion of you is the opinion of other investors. Which is of course a recipe for exponential growth. When one investor wants to invest in you, that makes other investors want to, which makes others want to, and so on.”

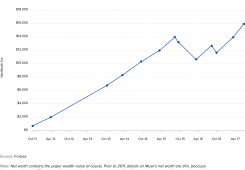

Current Traction or Progress

Regardless of what stage your company is in, including compelling traction statistics will be received positively and can help build credibility among investors. Typically, “traction” include sales, traffic, downloads, or any other growth metrics to indicate scale and adoption. On this slide you can also include any strategic partnerships, large accounts or clients won, client testimonials, or accolades achieved. Feel free to include the logos of any clients or large customers.

Finance Expert Aleksey Krylov contends that entrepreneurs should “Always highlight milestones. A startup’s milestones can be associated with technology, product, regulatory, market or other developmental goals. Market testing and customer traction milestones tend to be of particular interest to investors.”

Below is an example from map creation platform Mapme, which includes press and user statistics.

Total Addressable Market (TAM)

The Total Addressable Market slide is meant to demonstrate to investors that the opportunity at hand is part of a larger market shift or trend. The TAM figure is meant to indicate the underlying revenue opportunity for a given product or service. As such, entrepreneurs often include the largest, most impressive statistics they can find from various research reports.

According to Reid Hoffman, founder of LinkedIn, however, the issue with most TAM slides is that they often quote huge numbers from research companies or reports that are incentivized to inflate those numbers. Therefore, Hoffman recommends that the TAM calculation utilize a “bottoms-up” approach—an approach focused on revenue and traction. If you do not use your own calculations, be sure to cite sources that are objective and independent. In general, Hoffman suggests that if you are to include a TAM slide, not to linger on it too long during the actual pitch.

Below is an example from personal finance app Mint. It details the assumptions used to calculate the total addressable market, an approach that can lend more credibility than simply showing the number itself.

The Pain Point

You’ve probably heard this advice before: you must spell out the “problem” you are looking to solve with your company, product, or service. It is particularly important to frame the problem in a way that people can easily relate to. You should view this slide as an opportunity to add a personal touch and connect with your audience.

According to Samir Chaibi, who has raised a $1.5 million seed round and prepared a $10 million Series A fundraising for multiple startups, “Too many times I see founders attacking a vertical without a clear-cut understanding of the problems users are experiencing that are not already solved by the incumbents. When you develop a pitch, be mindful about the pain points you want to focus on from the start. It is fine to show a growth path towards a broader set of offerings that will turn a startup into a category leader but your pitch deck should start with the specific problem you are solving, always.”

Below is example from data platform Mattermark:

Solution: Your Product or Service

You’ll want to immediately follow your “Problem” slide with the natural solution: your company’s product or service. On the same slide or on a separate slide, you’ll also need to spell out exactly what your company’s product or service involves, and why it is distinct from what already exists on the market. Showing your product is far more powerful than simply describing its functionality in words. If your company has a product ready to be demo-ed, this would be a natural point to introduce it to investors, either live or in a video. Otherwise, you can also include screenshots and powerful images or visuals. If you haven’t completed the product itself, include a mockup so investors have a visual aide. You should highlight your product’s key features, target user, product milestones and roadmaps, and key differentiating features.

Below is an example from online housing marketplace Airbnb, which chose to separate the Solution slide (Slide 3) from the Product slide (Slide 6).

Business or Revenue Model

In order to build investor confidence, you will want to address your company’s planned revenue model, pricing strategy, average account size, or sales and distribution model. To indicate that you are not simply making empty promises, you can include not just current revenue model plans, but also future ones. You can also include specific dates to demonstrate decisiveness. Of course, investors expect that your company will need some flexibility to iterate, so being decisive does not necessarily mean making decisions that are set in stone either.

Below is an example from personal finance app Mint, which details both current and future revenue models.

Marketing & Growth Strategy

This slide is meant to provide investors with insight into how you plan to growth and market your product or service. It’s also a slide with a lot of latitude. You can include anything from the various market channels you’ll use to promote your product (paid search, social media, email marketing, etc.) to hiring plans.

Below is an example from Mixpanel:

Financials

Investors will want to understand the company’s current financial situation and future burn rate, the rate at which a new company is spending its financing before generating positive cash flow from operations. Separate from the pitch deck, you should have your financials ready in Excel if investors are interested in more detail. This will allow you to present a simpler summary in the deck itself.

Below is an example from mobile payment service Square, which actually exhibits “best,” “base,” and “worst” case financial scenarios. This approach can help investors understand the general range of the projections, and can appeal to conservative and optimistic investors alike.

Competitive Landscape

It’s all relative. Even if you’ve built the most comprehensive product on the market, perhaps it’s a low barrier-to-entry industry, or there are already a couple giant competitors to contend with. Therefore, your “Competitive Landscape” slide should address the following questions: Who are your company’s competitors? How is your company different from them, and what are your competitive advantages? Including more details helps to build investor confidence.

Below is an example from business social networking service LinkedIn, which not only includes the company’s competitors, but also indicates their relative positions in the market.

Investment “Ask”

Be clear about what you are asking for. Demonstrate that you have thought about your “ask” carefully and haven’t just plucked the amount you’re looking to raise out of thin air. Toptal Finance Expert Aleksey Krylovrecommends specificity: “I recommend my clients be very specific about their target number as opposed to using a range. They should be conservative in their estimates, as a lower targeted raise is more likely to close quickly.”

Krylov also advises including information on how you will use the proceeds, adding, “In my experience, it is important for building trust. It should highlight that the capital sought is not going to be used to maintain the founder’s lifestyle. The slide also needs to communicate that the money raised will bridge the company through the next value creation milestone(s). Investors like stories where step up in valuation is highly likely from the current round to the next.” You should show your 18-24 month plan and how much you’ll need to execute on that strategy.

Below is an example from marketing software company Intercom:

Resources

If you are interested in downloading or utilizing pitch deck templates, the following have been provided by venture capital funds: Google Ventures, Sequoia Capital, NextView Ventures.

Conclusion

As a parting thought, it is worth keeping in mind the following: In today’s world where startup fundraising has been glamorized to such an extent that raising capital is portrayed as a key success metric, one must remember to think about whether your “ask” is what your company actually needs. As Chris Dixon of Andreessen Horowitz says, “The best thing is to either never need to raise money or to raise money after you have a product, users, or customers.” Equity is the most expensive form of capital, so be sure to have truthfully assessed your startup’s needs, as opposed to feel like you have to fundraise just because it is the prescribed path for technology startups.

And if you do decide that you really need to fundraise, be clear about how much you need to raise, and what exactly it will be used for. The following two blog posts from legendary investor Fred Wilson can get you started: What Seed Finance Is For and How Much Money to Raise.

The art of fundraising is one that, if mastered, can often mean survival for your newly-established startup. In fact, you’ll also need to master the art of persuasion through Aristotle’s three modes of persuasion. The web is awash with advice on these matters, but much of the material out there is, frankly, not high quality. Should you need it, at Toptal, we have an array of experienced fundraising experts and pitch deck consultants who can help you craft successful pitches and fundraising strategies.

UNDERSTANDING THE BASICS

What is a pitch deck?

A pitch deck is a brief PowerPoint presentation used by companies seeking external funding. The presentation includes key highlights from the company, used by entrepreneurs as a persuasive tool and used by investors to learn more about the investment opportunity.