Key Highlights

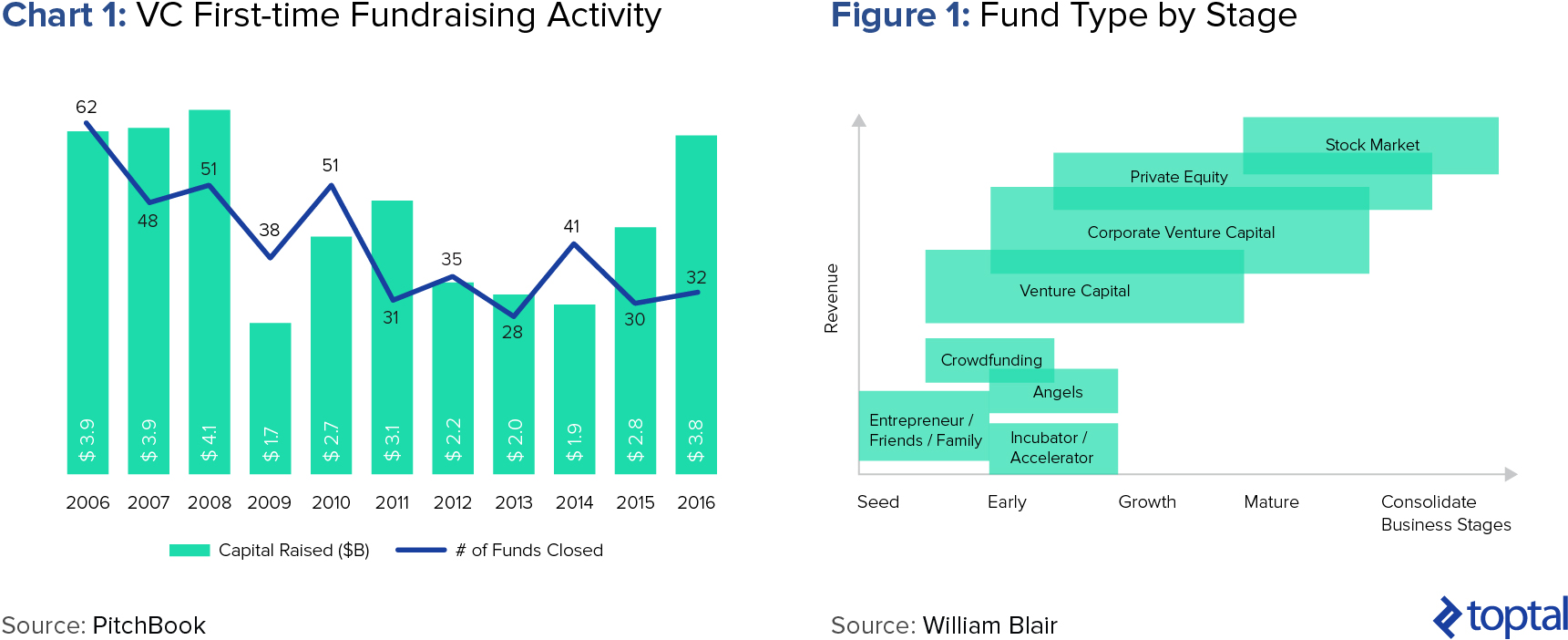

- Growth in startups worldwide has seen an influx of new professionals into venture capital. $3.8bn across 32 first-time manager funds was raised in 2016, continuing the trend over the last 5-7 years.

- Returns for the asset class as a whole continue to be lackluster. VC returns haven’t significantly outperformed the public market since the late 1990s, and, since 1997, less cash has been returned to investors than has been invested into VC.

- A driver of these returns is the decreasing barrier to entry for the industry and the basic mistakes made by many new entrants.

- VC is a game of home runs, not averages. Strikeouts are extremely common. 65% of venture deals return less than the capital invested in them. But strikeouts don’t matter. The best performing funds actually have more strikeouts than mediocre funds.

- The vast majority of a venture fund’s returns come from a few home run investments. For the best performing funds, less than 20% of their deals generate 90% of the returns.

- Not only do the best funds have more home runs, they have bigger, better home runs.

- Home runs are also extremely rare; the chances of hitting one are in the 0.5-2% range.

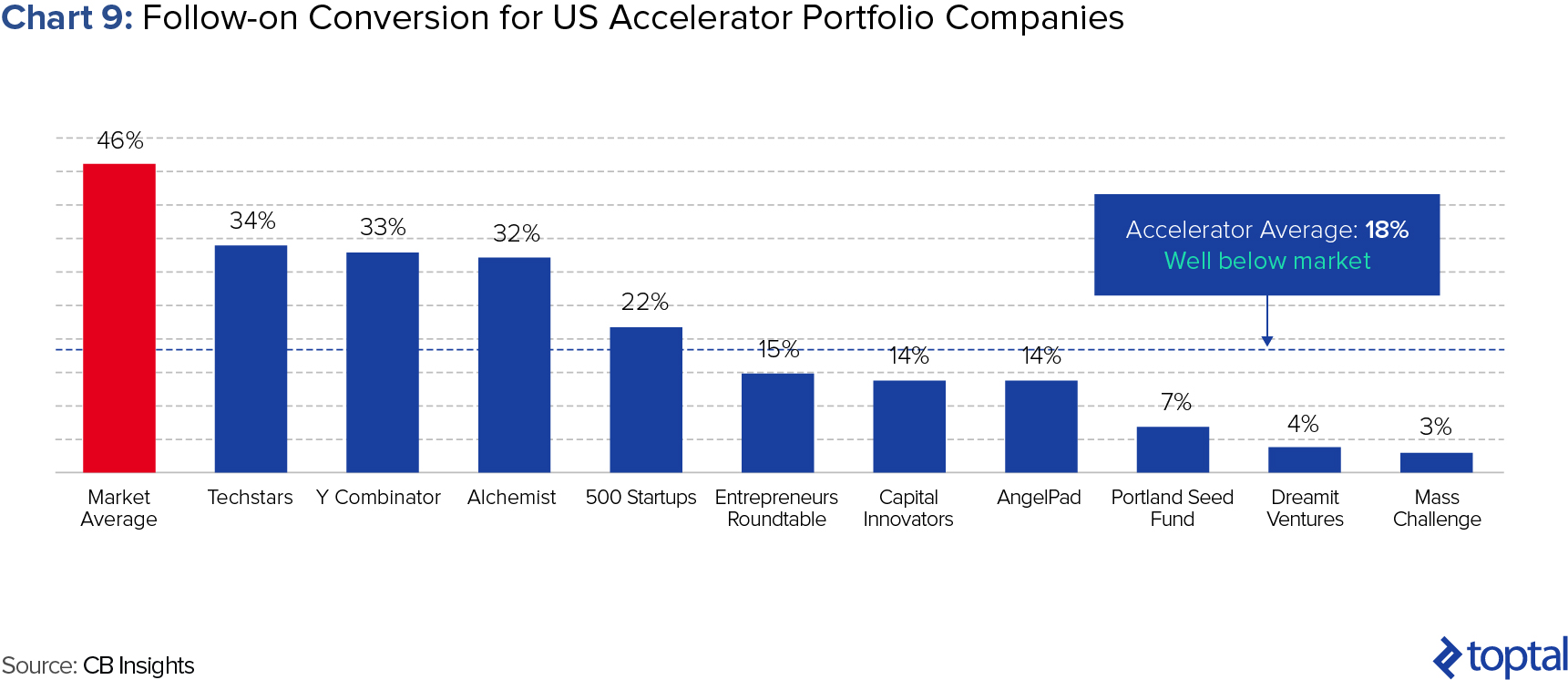

- Some funds (e.g., 500 Startups) have gone for a strategy of maximizing at-bats. However, larger portfolios come at the detriment of quality. The ratio of accelerator-funded startups receiving follow-on investments is 18%, significantly below the market average of c. 50%.

- Top US VC funds tend to do 1-20 investments per year, with the larger funds focused on the lower end of this range. Within a 4-5 year investment period, this implies a portfolio size of less than 50. Conventional wisdom in the VC space seems to be for there to be 20-40 companies in a given portfolio.

- Many newcomers to the space fail to reserve sufficient capital to follow-on in the companies they have invested in. Andreessen Horowitz’ 2010 investment in Instagram of $250k, for instance, returned 312x in less than two years. Whilst being an incredible return on a deal basis, at a fund level Andreessen would have had to invest in 19 other companies on the same terms and with the same incredible performance to break even on the fund as a whole, illustrating the importance of following-on in the home run investments in a portfolio.

VC: The En Vogue Asset Class

From humble beginnings, the venture capital (VC) industry has exploded into one of the most significant, and certainly best-known, asset classes within the private equity space. Venture-backed startups are some of the most disruptive and influential companies of our generation. The venture capitalists backing them have also taken their spot in the limelight, with the likes of Marc Andreessen, Peter Thiel, and Bill Gurley gaining recognition far beyond the confines of Sand Hill Road. You could compare this cult of personality to that of “corporate raider” era of the 1980s, when Michael Milken et al catalyzed the start of the LBO and junk-bond boom.

Partly as a result of this, the venture capital space has seen an influx of participants and professionals. First-time fund managers continue to raise new VC funds at healthy clips (Chart 1), and the once clear lines separating venture capital from private equity, growth equity, and other private asset classes have begun to blur (Figure 1). Corporates have also shifted into the space, creating venture arms and participating in startup funding at ever increasing levels. And perhaps the greatest sign of the times, celebrities such as Kobe Bryant, Jay Z, and Derek Jeter have all thrown their hats into the startup-investment ring. As John McDuling puts it, “Venture capital has become [one of] the most glamorous and exciting corners of finance. Rich heirs used to open record labels or try their hand at producing films, now they invest in start-ups.”

Succeeding in venture capital is not easy. In fact, while data assessing the asset class as a whole is scarce (and data on individual fund performance is even harder to come by), what is clear is that the asset class has not always lived up to expectations. As CB Insights points out, “VC returns haven’t significantly outperformed the public market since the late 1990s and, since 1997, less cash has been returned to investors than has been invested in VC.” Even the most well-known venture funds have come under scrutiny for their results: At the end of last year, leaked data showed that results for Andreessen Horowitz’ first three funds are less than spectacular.

The reasons for this lackluster performance are of course varied and complicated. Some believe that we may be in a bubble, which, if true, could explain the less-than-satisfying results of many funds (inflated values slowing the rush towards exits and offering a higher risk of valuation down rounds). Others argue that current fund structures are not properly set up to incentivize good performance. Scott Kupor’s response to the leaked results of Andreesen Horowitz also gives a defensive angle to this narrative, in that the lack of a wider understanding of the performance of the VC asset class drives the negative rhetoric.

But while all of this may or may not be true, another potential reason for lackluster performance amongst many funds is that they’re not following some of the fundamental principles of VC investing. As former bankers and consultants reinvent themselves as venture capitalists, they fail to assimilate some of the key differences that separate more established financial and investment activities from the more distinct form of venture investing.

To be clear, I am firmly within this camp. As someone who made the transition from the more traditional realms of finance into the world of venture investing, I have witnessed firsthand the differences between these activities. I am not in any way annointing myself as a venture capital guru, but through continual learning, I acknowledge and respect some of the important nuances that distinguish venture capital from other investing activities. The purpose of this article is therefore to highlight three of what I believe to be the most important venture capital portfolio tactics that many participants in the space fail to internalize.

1. Venture Capital Is a Game of Home Runs, Not Averages

The first, and arguably most important, concept that one has to understand is that venture capital is a game of home runs, not averages. By this, we mean that when thinking about assembling a venture capital portfolio, it is absolutely critical to understand that the vast majority of a fund’s return will be generated by a very few select companies in the portfolio. This has two very important implications to one’s day-to-day activities as a venture investor:

- Failed investments don’t matter.

- Every investment you make needs to have the potential to be a home run.

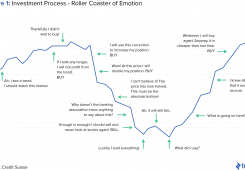

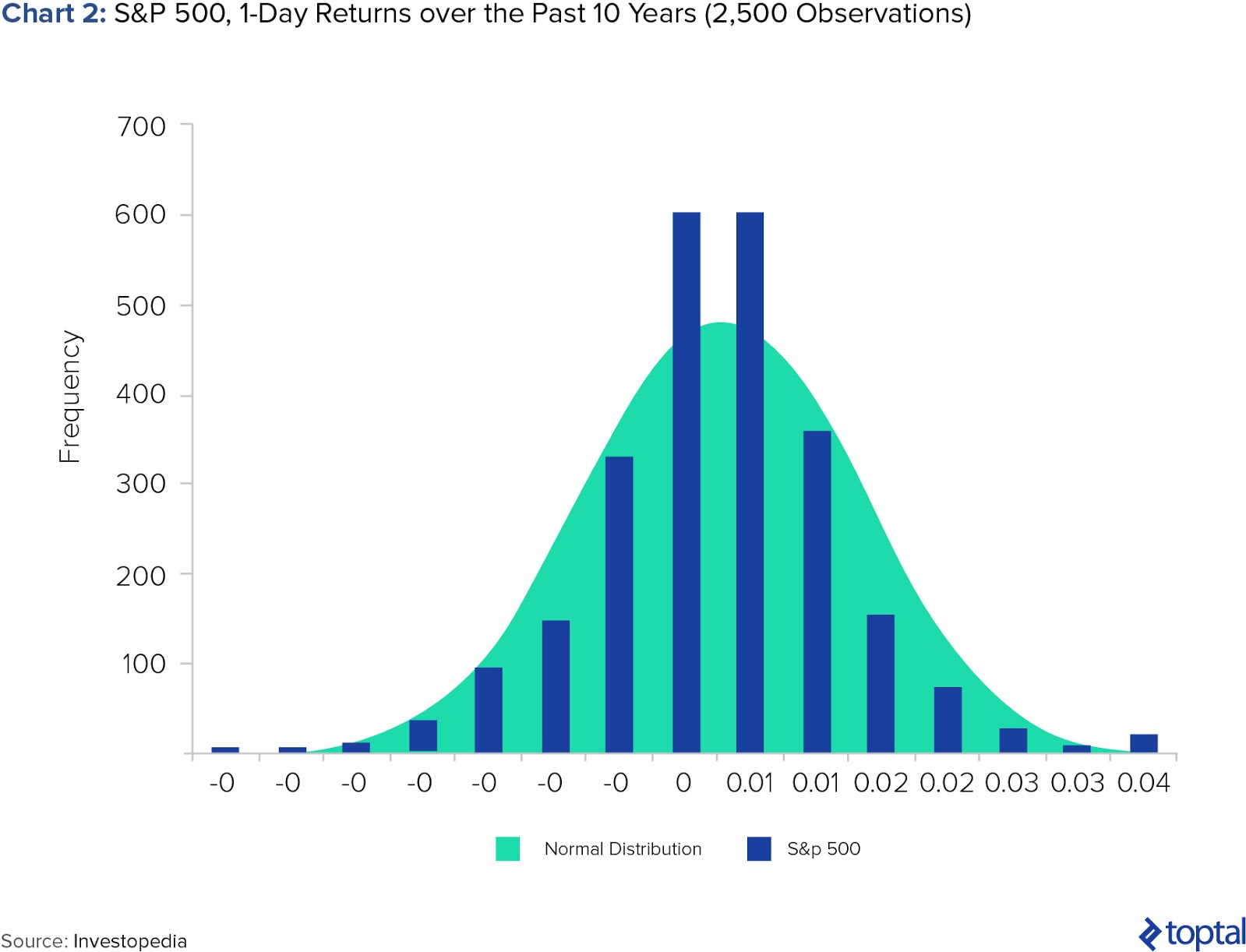

To many, particularly those from traditional finance backgrounds, this way of thinking is puzzling and counterintuitive. Conventional financial portfolio strategy assumes that asset returns are normally distributedfollowing the Efficient-market Hypothesis, and that because of this, the bulk of the portfolio generates its returns evenly across the board. A 2014 10-year analysis of 1-day returns from the S&P 500 in fact conforms to this bell curve effect, where the mode of the portfolio was more or less its mean (Chart 2).

Turning away from the more liquid public markets, investment strategies in private markets also strongly emphasize the need to balance a portfolio carefully and manage the downside risks. In a recent interview with Bloomberg, legendary private equity investor Henry Kravis said this:

“When I was in my early 30s at Bear Stearns, I’d have drinks after work with a friend of my father’s who was an entrepreneur and owned a bunch of companies. “Never worry about what you might earn on the upside,” he’d say. “Always worry about what you might lose on the downside.” And it was a great lesson for me, because I was young. All I worried about was trying to get a deal done, for my investors and hopefully for myself. But you know, when you’re young, oftentimes you don’t worry about something going wrong. I guess as you get older you worry about that, because you’ve had a lot of things go wrong.”

And putting aside what we are taught from financial theory altogether, Chris Dixon mentions how the adversity to losses may be an in-built human mechanism:

“Behavioral economists have famously demonstrated that people feel a lot worse about losses of a given size than they feel good about gains of the same size. Losing money feels bad, even if it is part of an investment strategy that succeeds in aggregate.”

But the crux of the point with venture capital investing is that the above way of thinking is completely wrong and counterproductive. Let’s run through why that is.

Strike-outs Don’t Matter

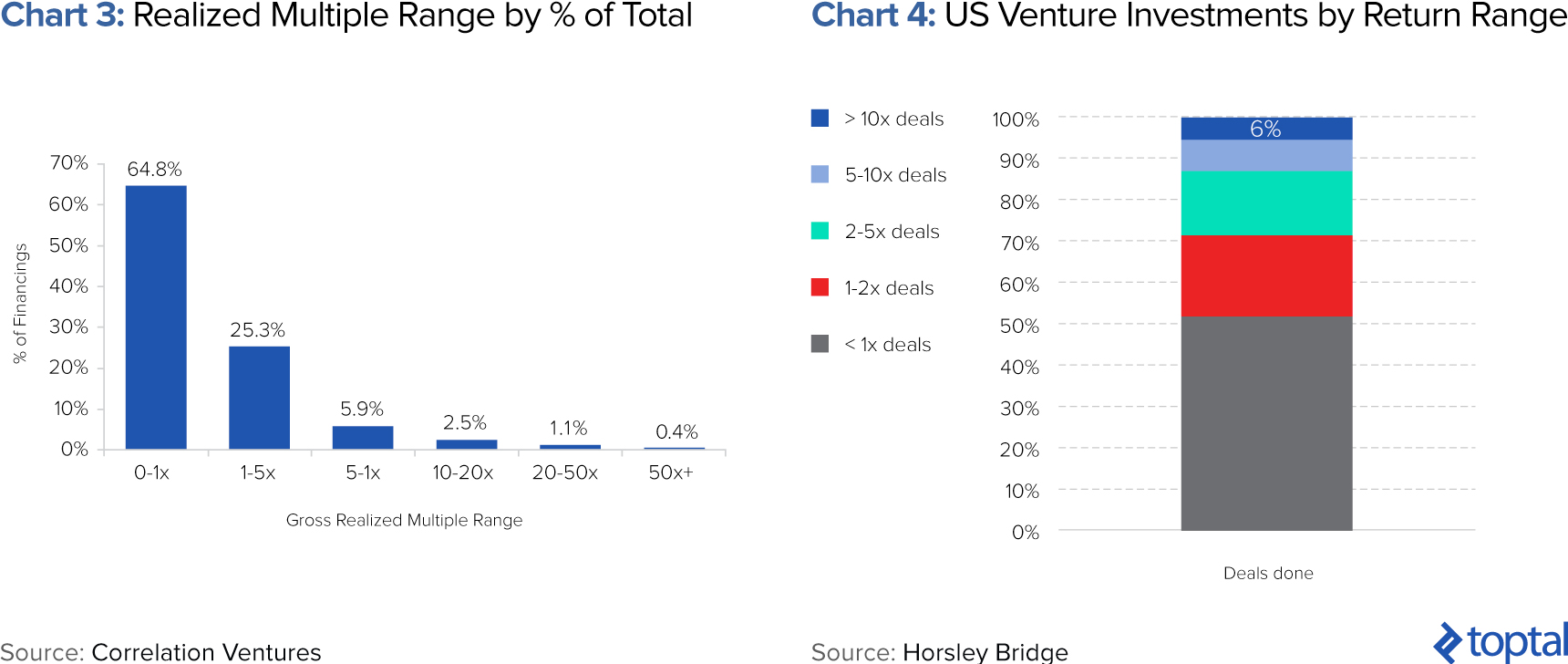

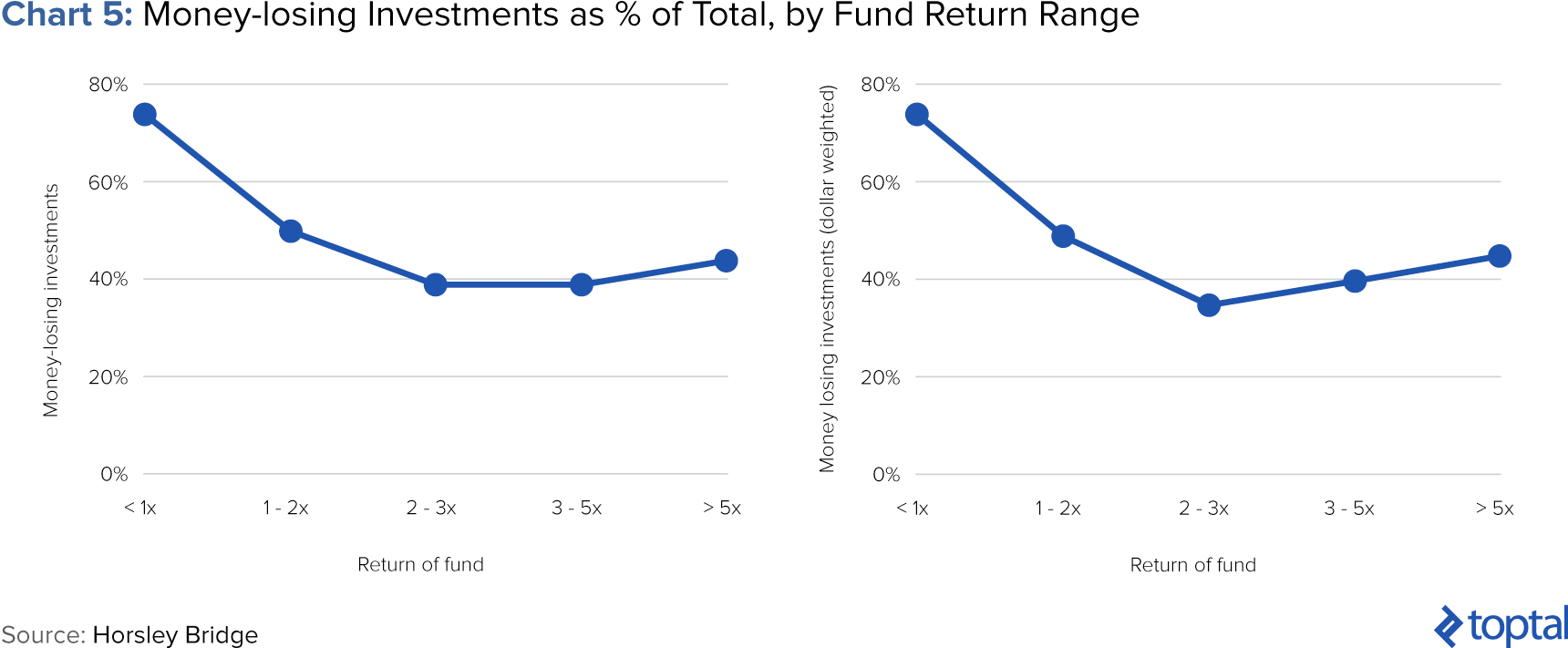

Most new companies die out. Whether we like it or not, it happens frequently. And unfortunately, there is ample data to support this. The US Department of Labor, for instance, estimates that the survival rate for all small businesses after five years is roughly 50%, and falls dramatically to a low of 20% as more time passes. When it comes to startup investments by venture capital funds, the data is bleaker. A Correlation Ventures study of 21,640 financings spanning the years 2004-2013 showed that 65% of venture capital deals return less than the capital that was invested in them (Chart 3), a finding corroborated by a similar set of data from Horsley Bridge, a significant LP in several US VC funds which looked at 7,000 of its investments over the course of 1975-2014 (Chart 4).

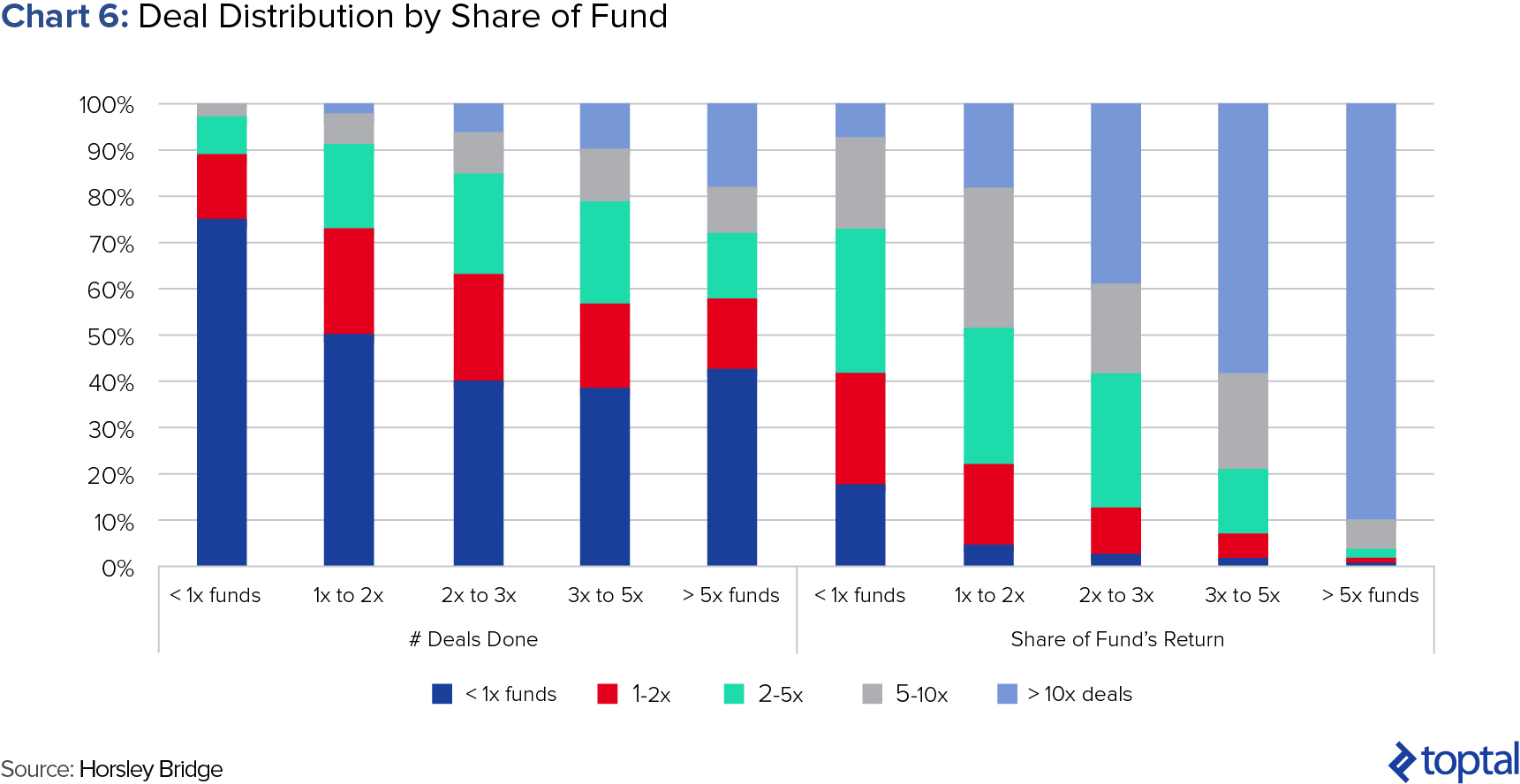

Attentive readers may of course point out that the failure rate of startup investments may simply be upward-skewed by a number of bad funds who invested poorly. And they’d be forgiven for thinking that. But the fascinating outcome of the Horsley Bridge data is that this is in fact not correct. Quite the opposite, the best funds had more strikeouts than mediocre funds (Chart 5). And even weighted by amount invested per deal, the picture is unchanged.

In other words, the data shows that the number of failed investments you make does not seem to be associated with the fund’s overall returns. It actually suggests that the two are may be inversely correlated. But if that’s the case, then what does drive a venture fund’s performance?

What Matters Are the Home Runs

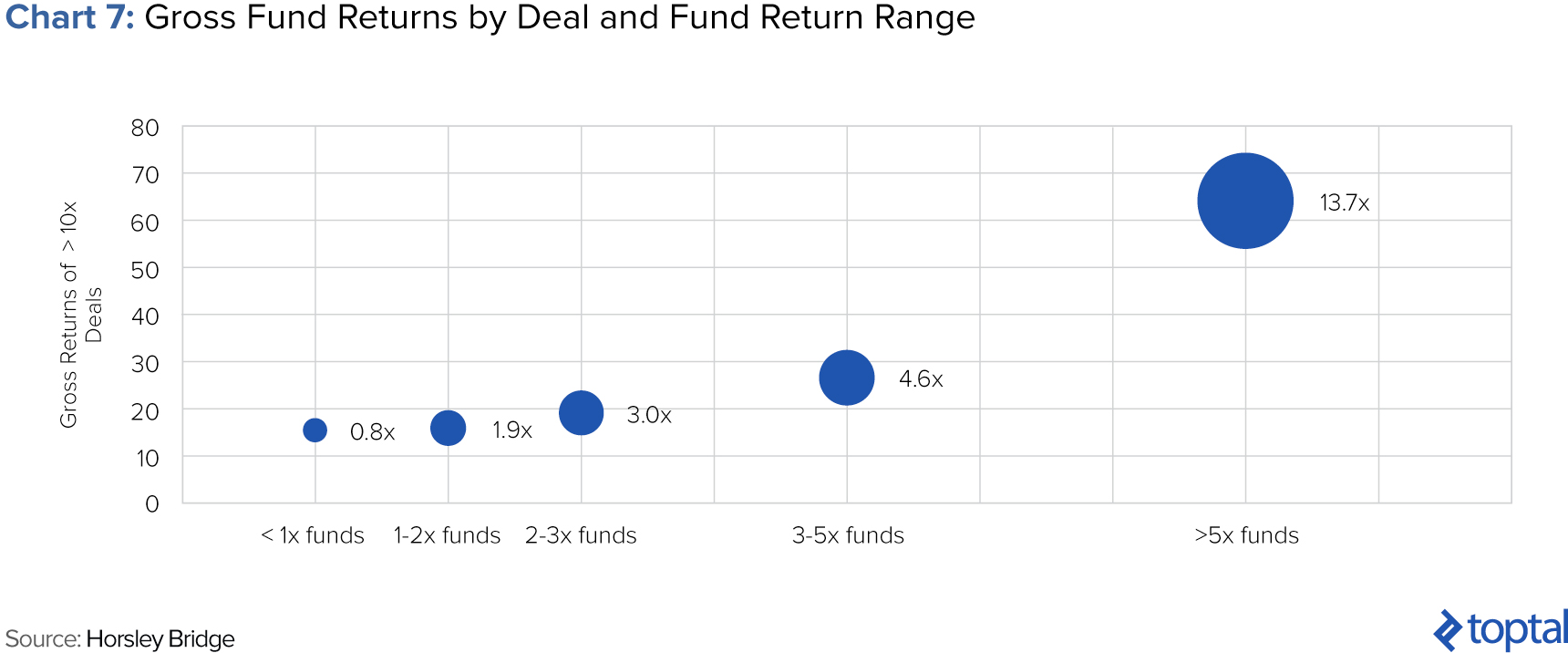

What matters is other side of the coin: the home runs. And overwhelmingly so. Returning to the Horsley Bridge data, one can clearly note how returns for its best performing funds are overwhelmingly derived from a few select investments that end up producing outsized results (Chart 6). For funds who had returns above 5x, less than 20% of deals produced roughly 90% of the funds’ returns. This provides a tangible example of the Pareto Principle 80/20 law existing within VC.

But it goes further than this: Not only do better funds have more home runs (and as we’ve seen above, more strike-outs too), but they have even bigger home runs (Chart 7). As Chris Dixon puts it, “Great funds not only have more home runs, they have home runs of greater magnitude,” or as Ben Evans summarizes, “The best VC funds don’t just have more failures and more big wins—they have bigger big wins.”

Whichever way one chooses to word it, the takeaway is clear. Venture capital fund returns are extremely heavily skewed towards the returns of a few stand-out successful investments. The investments end up accounting for the majority of the fund’s overall performance. Perhaps the best way to summarize all this comes from Bill Gurley, one of the most successful venture capitalists around. He stated, “Venture capital is not even a home run business. It’s a grand slam business.”

The Babe Ruth Effect in Startup Investing

The above has led to what is commonly referred to in the venture capital space as the “Babe Ruth effect” to startup investing. For those unfamiliar with Babe Ruth, he is widely considered to be one of the greatest baseball players of all time, and was elected into the Baseball Hall of Fame as one of its “first five” inaugural members. In particular, what made him so famous, and such a crowd-drawer, was his batting ability. Babe Ruth set multiple batting records, including “career home runs (714), runs batted in (RBIs) (2,213), bases on balls (2,062), slugging percentage (.6897), and on-base plus slugging (OPS) (1.164)”.

But what is surprising, and less well-known, is that Babe Ruth was also a prolific misser of the ball. In other words, he struck out. A lot. His nickname for many years was the King of Strikeouts. But how could the two things be reconciled? The answer lies in Ruth’s batting style. In his own words:

“How to hit home runs: I swing as hard as I can, and I try to swing right through the ball […] The harder you grip the bat, the more you can swing it through the ball, and the farther the ball will go. I swing big, with everything I’ve got. I hit big or I miss big. I like to live as big as I can.”

The reason why Babe Ruth has this abstract association with venture capital portfolio strategy is that the same principals behind Ruth’s batting style can, and should, be applied to startup investing. If strikeouts (failed investments) don’t matter, and if most of the returns are driven by a few home runs (successful investments that produce outsized results), then a successful venture capitalist should look to invest in those companies that display the potential for truly outsized results, and to not worry if they fail. To contradict Henry Kravis’ thoughts on private equity investing, in VC one shouldn’t worry about the downside, but just focus on the upside.

Jeff Bezos takes this analogy even further, contrasting the ceiling of a 4-run baseball grand slam to the infinite possibilities of a successful financial deal:

“The difference between baseball and business, however, is that baseball has a truncated outcome distribution. When you swing, no matter how well you connect with the ball, the most runs you can get is four. In business, every once in a while, when you step up to the plate, you can score 1,000 runs.”

2. How to Maximize Your Chances of Hitting a Home Run

Given all of the above, the logical follow-on question should be how one can maximize their chances of finding a home run investment. This is a contentious topic to answer and I am going to frame it across two areas that are worth looking into. The first is how one can assess each investment opportunity to ascertain its potential of being a home run, and the second relates to more general portfolio strategy and number of investments in order to maximize the chances of having a home run in your VC portfolio. I look at these in turn, starting with the latter:

More At-Bats = More Home Runs?

If we follow the probabilities laid out above regarding the percentage of hitting a home run, we will note that no matter what data set is chosen, the probabilities are very low. The Correlation Ventures data shows that less than 5% of investments return above 10x, and of those, only a tiny fraction are in the 50x+ category. Similarly, the Horsley Bridge data shows that only 6% of deals return more than 10x.

Following this logic, a reasonable conclusion might be the following: In order to maximize your chances of hitting a home run, you need to have more at-bats.

Several VCs have taken this path. The most notable, and outspoken proponent of this investment strategy is Dave McClure, founder of 500 Startups. In a now famous blog post, McClure outlines his thesis clearly:

“Most VC funds are far too concentrated in a small number (<20–40) of companies. The industry would be better served by doubling or tripling the average [number] of investments in a portfolio, particularly for early-stage investors where startup attrition is even greater. If unicorns happen only 1–2% of the time, it logically follows that portfolio size should include a minimum of 50-100+ companies in order to have a reasonable shot at capturing these elusive and mythical creatures.”

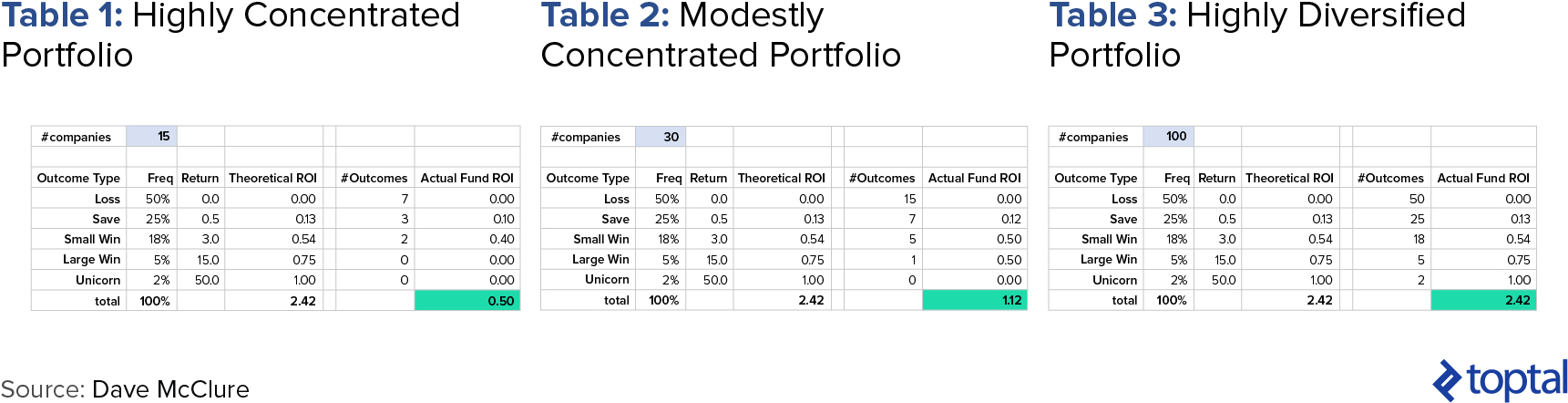

His thesis is backed by a few illustrative portfolio examples, which he uses to display the importance of portfolio size, and which we’ve reproduced below (Tables 1, 2, and 3)

His numbers rely heavily on an arguably overlooked concept when it comes to portfolio strategies: the law of rounding. He is of course right, in that you cannot have a fraction of a startup. Which means that, assuming the probabilities he uses are correct (and in fairness they seem aligned with other data sets we’ve seen), if you really want to be “sure” of landing on a unicorn, you need to invest in at least 50 startups for that to happen (given that he assumed a 2% change of investment turning into a unicorn.)

McClure’s overall point is an interesting one. It resembles the “moneyball-style” investment tactics that have emerged successfully in many other areas of finance. And as mentioned, several other funds have taken a similar approach. In a sense, this is a fundamental philosophy behind all accelerators and incubators.

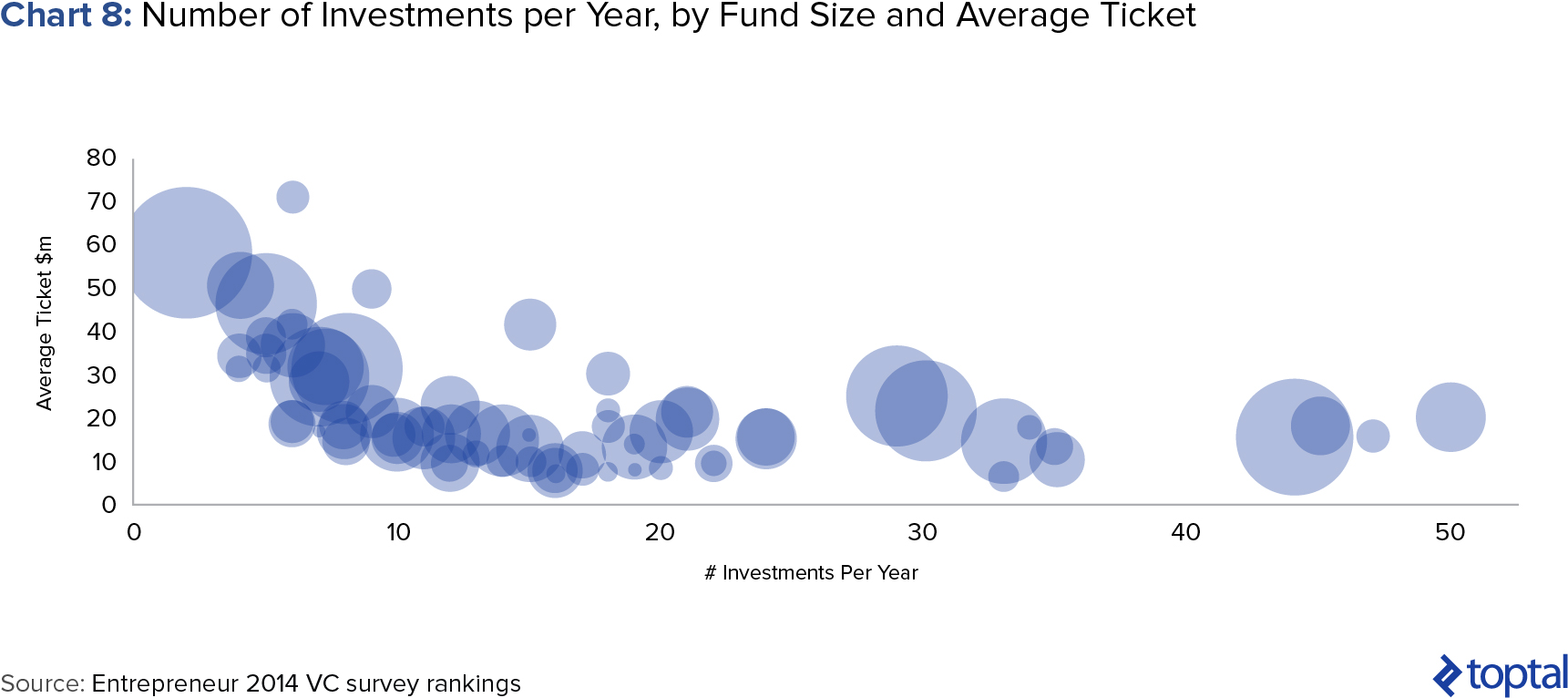

And yet, most venture capital funds do not follow this strategy. While information on fund size is hard to find, we charted data from Entrepreneur.com’s 2014 VC rankings and, showing a 3-way cross reference of number of deals (x) vs. average deal size (y) vs. fund assets under management (z), an interesting segmentation of the market emerges (Chart 8).

One can see in the chart above that the bulk of funds tend to do 1-20 investments per year, with larger funds (aside from a few outliers) focused on the lower end of the range. Within the context of a 4-5 year investment period, this leads to an implied portfolio size which is smaller than McClure’s suggested number. What is clear from the above is that the strategy of investing in many companies rather than fewer is not the norm. But if McClure’s analysis is correct, then why haven’t the majority of VC funds followed this approach? In McClure’s own words:

“My guess is it’s due to the mistaken belief by traditional VCs that they need to serve on boards directly, rather than simply securing the necessary voting rights and control they want that usually come with board seats. Or maybe they think they’re just better than the rest of us who aren’t tall, white, male, or didn’t go to the right schools. Or who don’t wear khakis. Or maybe it’s due to all those tee times, I’m not quite sure.”

It’s a colorful argument that has credibility from his experiences, but it is of course subjective and difficult to assess. Unfortunately, a data-driven approach at evaluating the true “value-add” that VCs bring to startups is near impossible. Nevertheless there are a few data points out there that seem to contradict McClure’s theory. Data from CB Insights, for instance, shows that the success rate of accelerator-funded companies to achieve a follow-on funding round are significantly lower than the market average (Chart 9). And if Forbes columnist Brian Solomon is correct in saying that “Only 2% of companies emerging from the top 20 accelerators have a successful exit yet” then that would again imply below-average results.

Piecing this all together shows that there probably is a tradeoff between portfolio size and quality. While there has been a huge increase in startup activity in recent years (meaning that the sample to choose from has grown a lot), it’s hard to believe that shooting for 100+ companies in a portfolio allows for a maintenance of quality standards. But the truth will ultimately come out in due course, as data becomes more publicly available and time is called on portfolios that have emerged in the last decade.

Picking the Winners Effectively

If one rejects the moneyball-style approach and instead embraces the more traditional doctrine which holds that VC firms should pick fewer companies and “cultivate” them to succeed, then an important question becomes: How can you pick your investments wisely in order to maximize the chances of landing on a home run?

This is of course an extremely difficult question to answer, and one that differentiates the successful venture capital investors from the rest. After all, if it were so easy, then the returns of the asset class would be far superior to what they really are. The practice of choosing which startups to invest in is more of an art than a science, and as such no definitive playbook can be laid out. Nevertheless, there are a few general points that emerge from scanning the writings of the best investors.

Team

In an investment decision, two factors are being assessed: the idea and the people behind it. More emphasis should be applied to assessing the team. Back the jockey, not the horse, so to speak. In the words of Apple and Intel early investor Arthur Rock:

“I invest in people, not ideas […] If you can find good people, if they are wrong about the product, they’ll make a switch, so what good is it to understand the product that they are making in the first place?”

Ideas are more malleable than people. Someone’s personality is far harder to change than executing a product pivot. The vision and talent of a founder is the drive behind everything in the company and, in these days of celebrity founders, it is also a branding exercise.

Empirical data is now being released that supports this theory. A study by by professors Shai Bernstein and Arthur Korteweg with Kevin Laws of AngelList found that on the latter’s platform, teaser emails about new Angel Deals that featured more prominent information about the founding team increased click rates by 14%.

Addressable Market Size

If each investment made needs to have the potential for outsized returns, then an obvious facet of these companies is that they have a large addressable market size. Total Addressable Market slides are now a mainstay of pitch decks (and equally so, a source of derision when they all contain the now-seemingly-obligatory $1 trillion market opportunity).

A deeper understanding of the dynamics of the market being tackled is necessary in order to understand how truly addressable this market is. This example from Lee Howler sums up this fallacy quite well:

“There’s $100bn+ spent each year on plane flights, hotels, and rental cars in the US […] but if you’re an upstart online travel service, you’re not competing for those dollars unless you actually own a fleet of planes, rental cars, and a bunch of hotels”

Investors want to see entrepreneurs that have a profound understanding of the value chains and competitive dynamics of the market that they are tackling. In addition, a startup needs to show a clear roadmap and USP of how they can carve an initial niche within this and grow, or move into horizontal verticals.

Scaleability/High Operating Leverage

Good venture investors are looking for startups that grow exponentially with diminishing marginal costs, wherein the costs of producing additional units continually shrink. The operating leverage effects of this allows companies to scale quicker, more customers can be taken on for little to no operational change, and the increased cashflows can be harvested back into investing for even more growth. How would an investor asses this at Day 0? Steve Blank provides a strong definition of a scalable startup:

“A scalable startup is designed by intent from day one to become a large company. The founders believe they have a big idea—one that can grow to $100 million or more in annual revenue—by either disrupting an existing market and taking customers from existing companies or creating a new market. Scalable startups aim to provide an obscene return to their founders and investors using all available outside resources”

Consider Tesla open sourcing its patents. This was not intended as a solely benevolent gesture by Elon Musk; instead, it was an attempt by him to accelerate innovation within the electric car space by encouraging external parties to innovate in his arena. More efforts to produce better technology (i.e., longer life batteries) will ultimately help Tesla to reduce its marginal costs faster.

The importance of operating leverage is one of the main reasons, amongst others, why venture capitalists often focus on technology companies. These tend to scale faster and more easily than companies who do not rely on technology.

An “Unfair” Advantage

Startups face up to deeper pocketed and more experienced incumbents with a goal to usurp them. To do this, they have to employ unconventional tactics that are not easily replicated by incumbents. An investor must look to what innovative strategies the startup is using to tackle larger competitors. Aaron Levie of Box sums this up in three forms of unfair advantage: via product, business model, and culture. Lets consider three examples of this.

An unfair product: Waze turns geo-mapping on its head by deploying its actual users to generate its maps for free. Exponentially quicker and making a mockery of the sunk costs incurred by incumbents like TomTom.

An unfair business model: Dollar Shave Club realizes that the majority of shavers care very little that Roger Federer uses Gillette and creates a lean, viral marketing campaign that delivers quality razors for a fraction of the price. It was impossible for incumbents to respond to this without cannibalizing their existing lines.

An unfair culture: The two former points will be driven by a culture in the startup that is more laser focused than an incumbent. Consider this example of Dashlane, which built a unified culture from eschewing traditional startup perks and using innovative video technology to bring its French and American offices together.

Timing

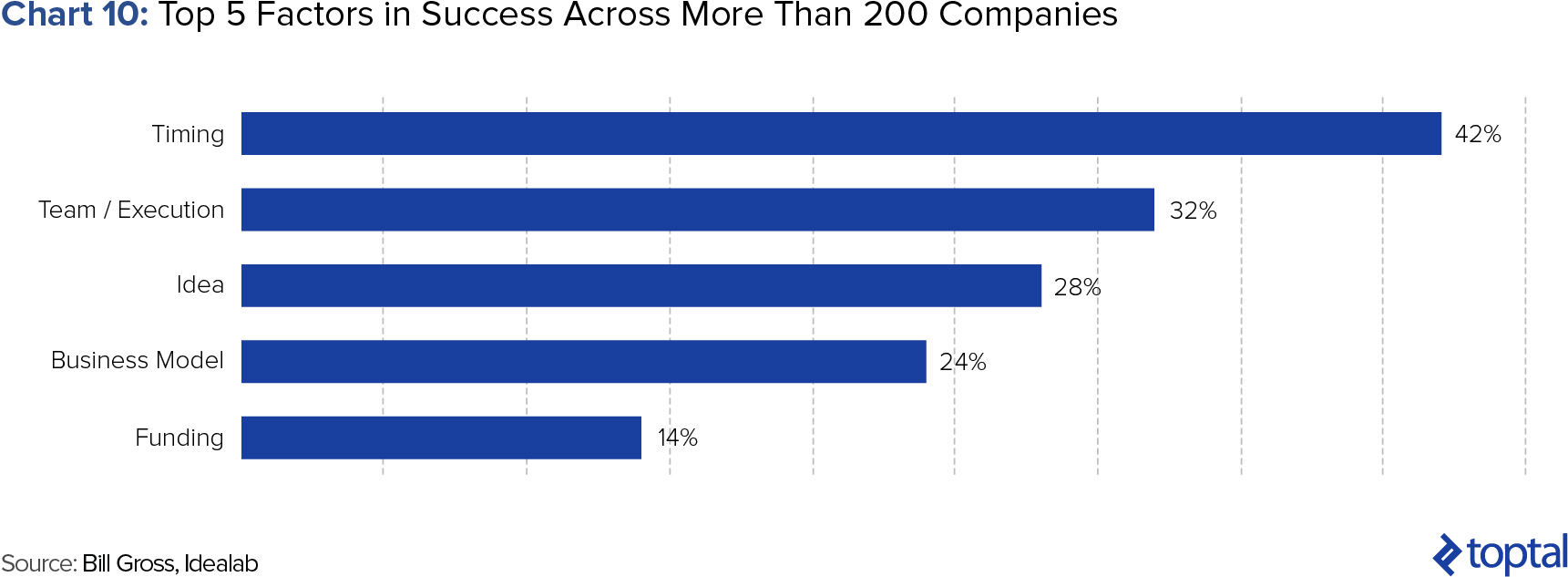

Through looking at the reasons for success across a range of startups, Bill Gross of Idealab concluded that timing accounted for 42% of the difference between success and failure (Chart 10). This was the most critical element from his study, which also accounted for team, idea, business model, and funding.

To give an example of how he defined this, he referred to Airbnb during his TED Talk:

“[Airbnb was] famously passed on by many smart investors because people thought, “No one’s going to rent out a space in their home to a stranger.” Of course, people proved that wrong. But one of the reasons it succeeded, aside from a good business model, a good idea, great execution, is the timing.”

Using the 2009 recession at the time to frame this:

“[This was at a time] when people really needed extra money, and that maybe helped people overcome their objection to rent out their own home to a stranger.”

A venture capital investor will look at the timing of startups as part of their investment process. Is the deal arriving at the optimal time and is this business model riding a macroeconomic or cultural wave? The investors in Airbnb will have had the vision to frame this investment away from the prevailing biases of the time and view it as a unique opportunity arriving at the opportune moment.

3. Follow-on Strategies: Doubling Down on the Winners

The final venture capital portfolio strategy that I want to highlight, and one that many newcomers to venture investing fail to account for, relates to follow-on strategy. By follow-on, I mean the ability and disposition to invest further capital into future fundraising rounds of the companies that are already in the portfolio.

The importance of follow-ons was illustrated by Peter Thiel in his book, Zero to One. In it, he gives the following example:

“Andreessen Horowitz invested $250,000 in Instagram in 2010. When Facebook bought Instagram just two years later for $1 billion, Andreessen netted $78 million—a 312x return in less than two years. That’s a phenomenal return, befitting the firm’s reputation as one of the Valley’s best. But in a weird way it’s not nearly enough, because Andreessen Horowitz has a $1.5 billion fund: if they only wrote $250,000 checks, they would need to find 19 Instagrams just to break even. This is why investors typically put a lot more money into any company worth funding. (And to be fair, Andreessen would have invested more in Instagram’s later rounds had it not been conflicted out by a previous investment). VCs must find the handful of companies that will successfully go from 0 to 1 and then back them with every resource.”

The example above demonstrates vividly the importance of follow-ons. If only a few investments end up being home runs, then a successful fund will identify that and double down on its winners to maximize the returns of the fund.

The actual decision of when to double down is, however, not as simple as it may seem. At a high level, the chart below shows how a venture investor should choose their follow-on targets, using the analogy of doubling down at the “elbow.” As the slide behind this chart explains: “1) Invest at “The Flat” when prices are low, 2) Double-down if/when you detect “The Elbow” (if valuation isn’t crazy), and 3) Don’t invest at “The Wall” unless capital is infinite—if valuation starts running away, you usually can’t buy any meaningful ownership relative to existing.””

Nevertheless, in real life, being able to distinguish between Startup W, Startup K, and Startup L is not that easy. Particularly between Startup W and Startup K. Mark Suster wrote a helpful post outlining his way of thinking about this issue, but the fact remains that the decision is not always a clear-cut one. But that is, of course, where, again, the best VCs will differentiate themselves from the also-rans. And as in the previous section, this is more of an art than a science. Successful following-on is a strong test of a venture manager’s chops, where they are presented with the sunk cost fallacy decision, of pouring more money into a loser in the hope it turns around, or letting the investment die.

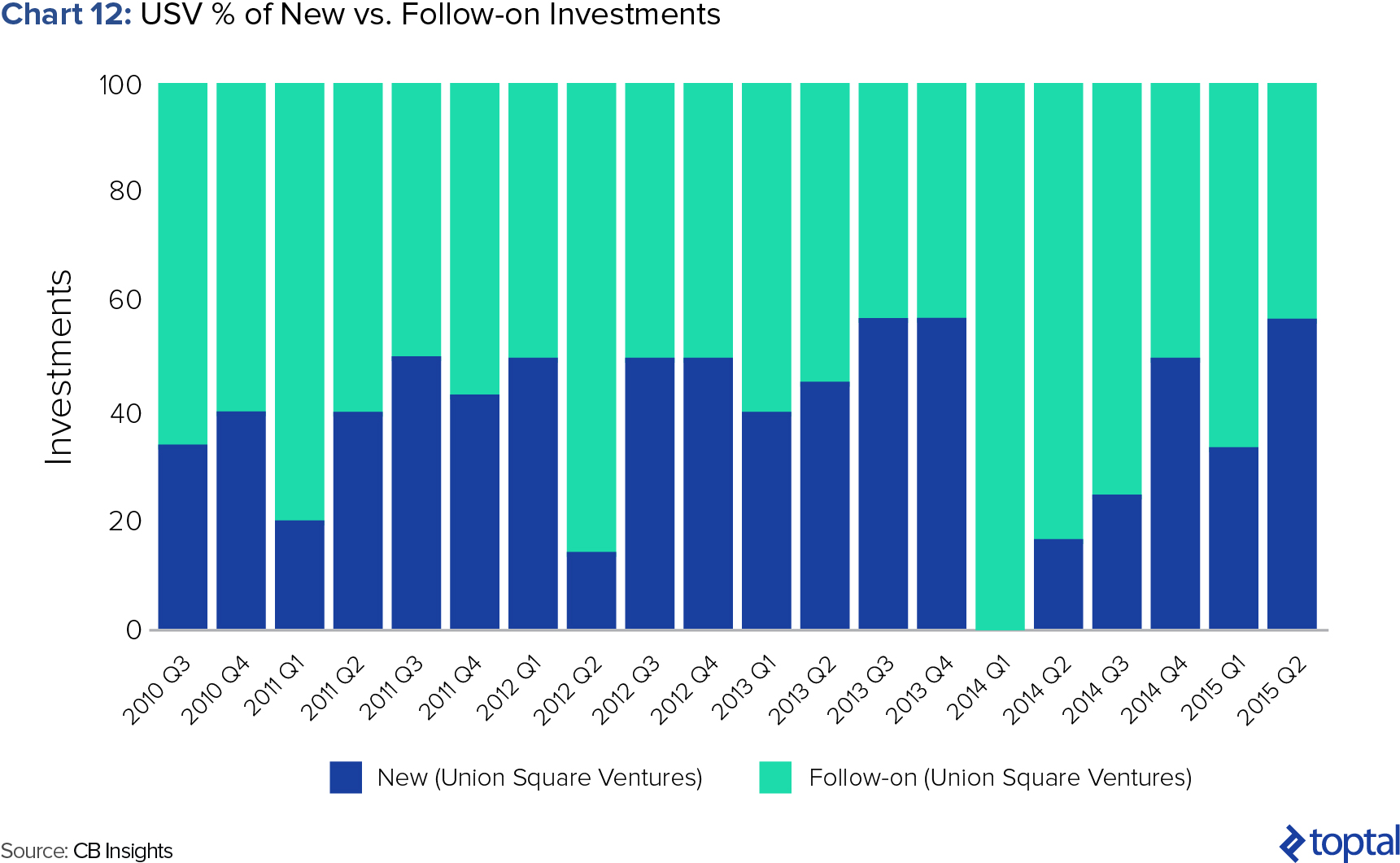

The importance of follow-ons to a fund’s overall returns stands out in the publicly available data. Union Square Ventures’ 2010 Opportunity Fund had a calculated IRR of 60.59% (Pitchbook), making it an extremely successful VC fund. If we look at follow-on trends (CB Insights) for USV after this period, we can see the majority of their funding choices were going as follow-ons into their winners. They were doubling down and the fund result shows that this was indeed a profitable strategy.

This post has been about highlighting certain often overlooked venture capital portfolio strategies that serve to maximize performance. And this last point around follow-ons should not be considered least. Fred Wilson of USV sums it up:

“One of the most common mistakes I see new “emerging VC managers” make is that they don’t sufficiently reserve for follow-on investments. They don’t go back for a new fund until they have invested 70 to 80% of their first fund and then they run out of money and can’t participate in follow-on rounds. They put too many companies into a portfolio and they can’t support them all. That hurts them because they get diluted by those rounds they can’t participate in. But it also hurts their portfolio companies because the founder and/or CEO has to explain why some of their VC investors aren’t participating in the financing round.

Most people think that VC is all about the initial portfolio construction, selecting the companies to invest in. But the truth is that is only half of it. What happens with the portfolio after you have selected it is the other half. That includes actively managing the portfolio (board work, adding value, etc.) and it includes allocating capital to the portfolio in follow-on rounds, and it includes working to get exits. And it is that second part that is the harder part to learn how to do. The best VC firms do it incredibly well and they benefit enormously from it.”

At the start of this section, I said following-on was an overlooked part of VC. This is because the initial investments and their associated glamor of pitch decks and coffee meetings are the tip of the iceberg. The home runs are followed out of the park with the 66% of the fund that is reserved for follow-ons.

Optimizing for the Power Law

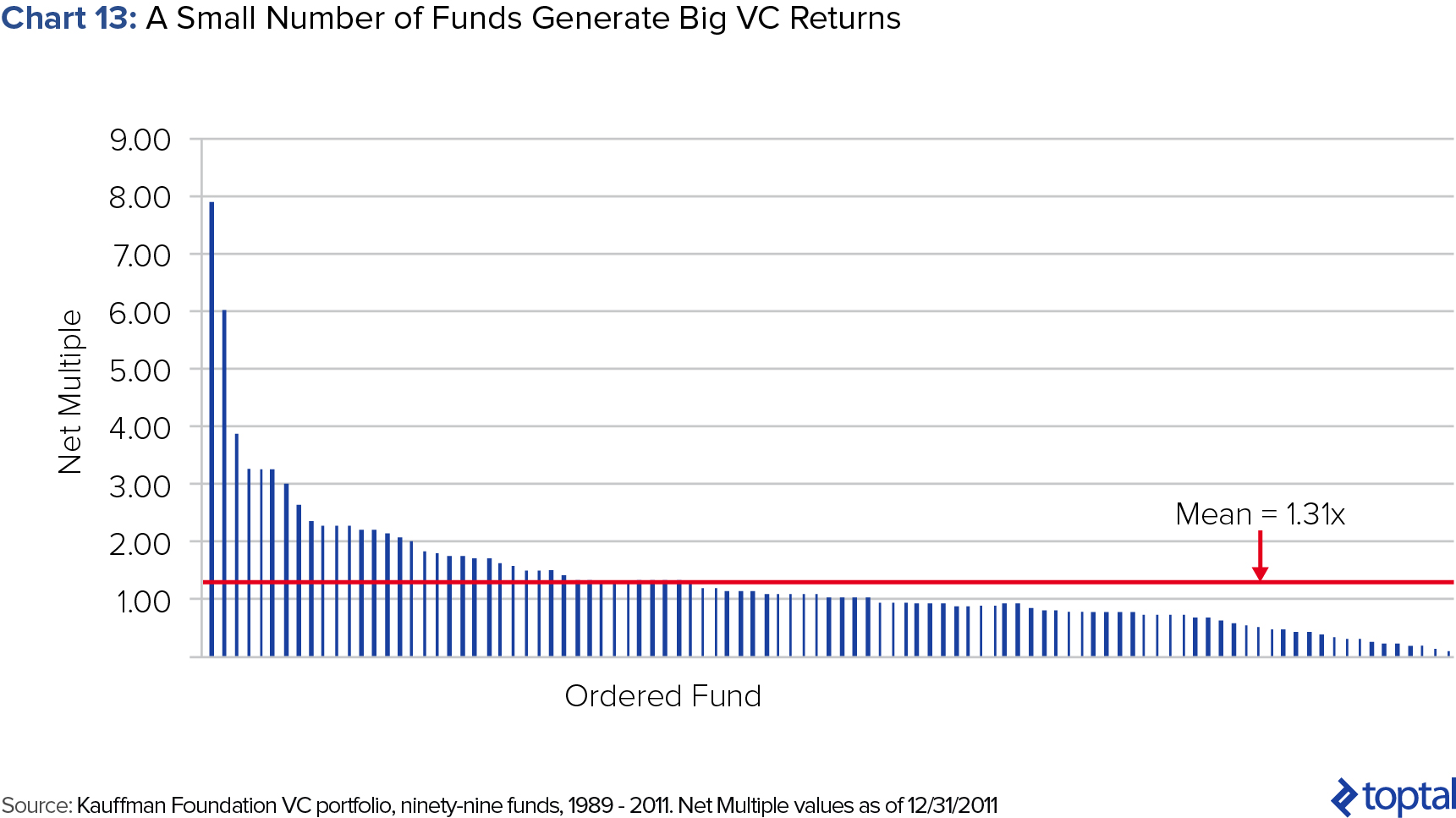

At the beginning of this article, we mentioned how the venture capital industry, as an asset class, has posted generally unsatisfactory returns. A fascinating report by the Kauffman Foundation shed further light on the issue and produced some interesting results. In the report, called We Have Met the Enemy and He is Us, the Foundation found that when looking at a collection of venture capital funds, only a few were responsible for most of the returns for the asset class as a whole (Chart 13).

In many ways, the performance of funds is analogous to the performance of venture deals: a few home runs and a lot of strikeouts. The shape of fund level returns follows a similar pattern to the distribution of single deal returns shown in the Correlation Ventures study in Chart 3 at the beginning of this article in which the 50x deals constitute a tiny portion of the sample, but with a significant magnitude of absolute returns.

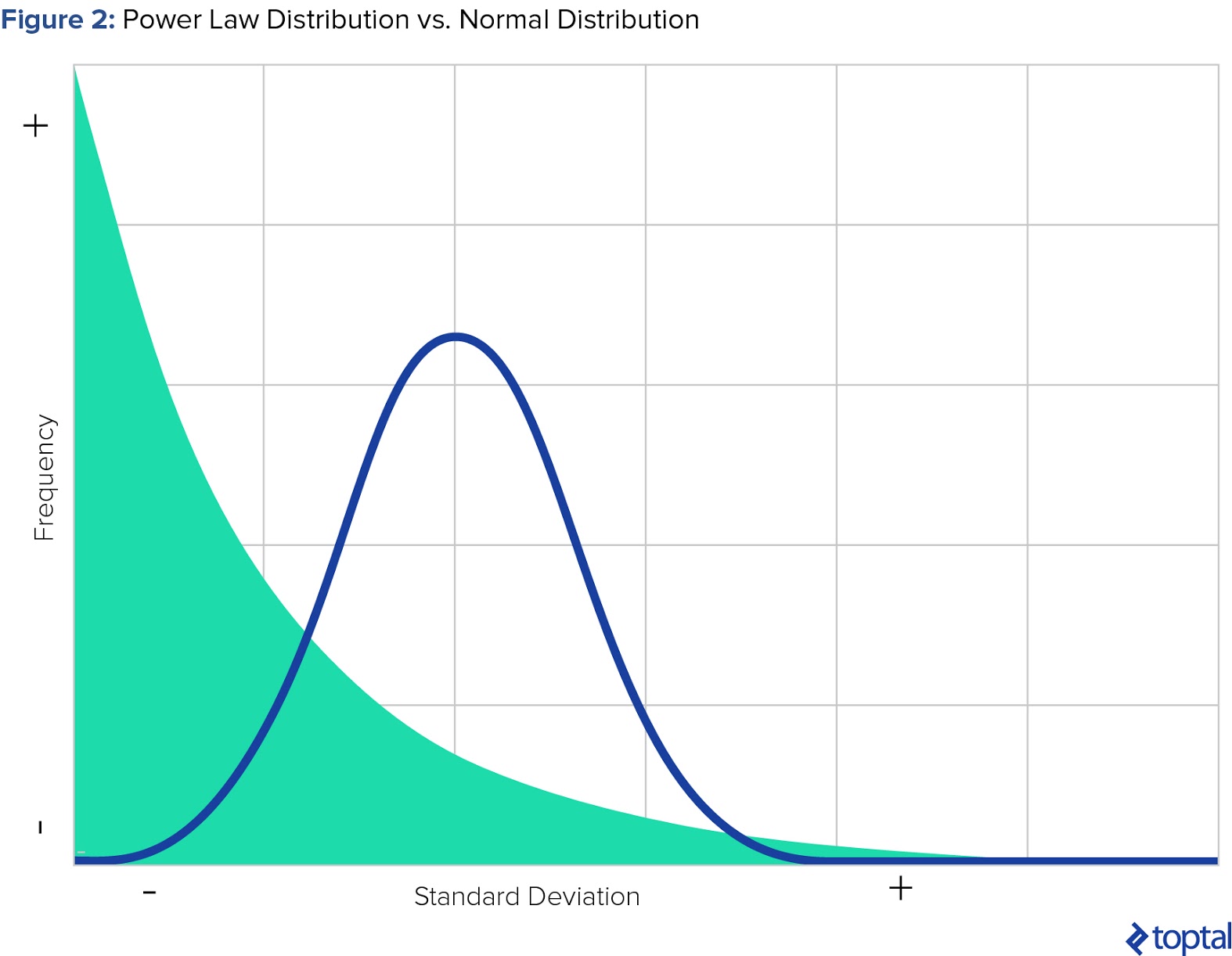

The implication of the above is very significant. Readers will recall how returns of public stocks seemingly follow a normal distribution. What we hope to have conveyed in this article is that returns in the venture capital space, both at a deal level as well as at a fund level, do not follow a normal distribution. Rather, they seem to follow a power law distribution, a long-tail curve where the vast bulk of the returns are concentrated within a small number of funds. Figure 2 below illustrates the difference between a power law distribution and the more common normal distribution.

The concept of the VC industry conforming to a power law distribution was rendered popular by Peter Thiel in Zero to One. In it, he said:

“The power law becomes visible when you follow the money: in venture capital, where investors try to profit from exponential growth in early-stage companies, a few companies attain exponentially greater value than all others. […] We don’t live in a normal world, we live under a power law.”

On an empirical level, evidence is arising to support this claim. Dario Prencipe of the European Investment Fund performed a detailed and fascinating statistical analysis of the fund’s returns from VC, which showed preliminary evidence supporting this power law principal. Investor Jerry Neumann also offers an in-depth look into the concept of power law existing in venture capital.

All of this implies that investors looking to succeed in the venture capital space must internalize the concepts and implications of the power law. Whether it is empirically and mathematically correct that the VC industry’s returns are distributed according to a power law is perhaps still a question, but conceptually, it is very clear that the venture capital space is very much an “outlier-driven” industry.

Not only this, but once one has internalized the concepts underlying the power law, one then needs to think about how to tactically use this to one’s advantage. The concepts we’ve outlined above regarding the number of at-bats and the importance of follow-ons are some of the more important ways one can do it.

The proliferation of startup “culture” and venture capital investing worldwide is arguably a positive phenomenon for the world. Paraphrasing Peter Relan, “[The world] needs new ideas, and citizens can’t expect the government to foster tomorrow’s disruption […] [Startups] have become a pathway to achieve this approach; they give people an opportunity to make their dreams come true. And even if most of these ideas fail, they will still create innovations that can be reflected in the product technology in other spaces.”

So the influx of new professionals into the venture capital space is a good thing. But for this all to continue and succeed, LPs need to see positive results for their investments. If only a few venture capital funds really know what they’re doing, and drive most of the returns for the asset class, then perhaps the solution would be for there to be fewer venture capital funds. But following on the above, that could be detrimental to society. Instead, we’d like to think that the solution should be the other way around: More venture capital funds should know what they’re doing. Hopefully this article can, even in a small way, be helpful in that regard.