Key Highlights

- The Glass-Steagall Act of 1933 effected a separation between commercial and investment banking activities. Prior to its implementation, J.P. Morgan & Co. operated in commercial banking and securities activities. Afterward, it split into investment bank Morgan Stanley and commercial bank JPMorgan.

- After decades of erosion, two provisions of the Act were repealed in 1999 by the Gramm-Leach-Bliley Act under then President Clinton’s administration. It allowed for universal banking under one structure.

- Two remaining provisions are still intact today: They limit investment management firms like Bridgewater Associates from offering checking accounts and prohibit commercial banks like Wells Fargo from dealing in risky securities such as cattle futures.

- The repeal ushered in a period of mega-mergers. The new six largest banks grew their assets from 20% of GDP in 1997 to over 60% of GDP in 2008.

- The percentage of borrowers who defaulted on their mortgages nearly doubled from 2006 to late 2007, in large part due to imprudent lending standards.

- Debate has centered around whether Glass-Steagall’s absence led to a decline in underwriting standards. A study found that securities issued through universal banks had “a significantly higher default rate” compared to those issued by investment companies.

- Citigroup eventually required the largest financial bailout in history, to the tune of $476.2 billion from the government and taxpayers, lending credence to the claim that Glass-Steagall’s absence caused the financial crisis.

- However, most too-big-to-fail institutions were actually pure investment banks or insurance companies, not universal banks (e.g., Lehman Brothers, Bear Stearns, Merrill Lynch, AIG).

- Ironically, Glass-Steagall’s repeal allowed for the rescue of some institutions after the crisis. It enabled JPMorgan Chase to rescue Bear Stearns and Bank of America to rescue Merrill Lynch.

- Leading up to the crisis, the shadow banking repo market exploded, growing from $2 trillion in 1997 to $7 trillion in 2008. The repo market’s growth is indicative of the overall growth in shadow banking, whose liabilities had far surpassed those of the traditional banking sector by 2008.

- Did Glass Steagall’s absence enable commercial banks to fuel the growth in the shadow banking sector? “Commercial banks could have done all of those things in the 1960s or earlier, even before the Fed and the OCC court decisions began to loosen the structures of Glass-Steagall.” –Lawrence J. White, financial regulation expert at New York University

- Overall, while the general consensus is that Glass-Steagall’s absence was not a principal cause of the crisis, the underlying culture of excessive risk-taking and short-term profit was real. According to the Financial Crisis Inquiry Commission, “The large investment banks […] focused their activities increasingly on risky trading activities that produced hefty profits […] Like Icarus, they never feared flying ever closer to the sun.”

Introduction

Over the last several years, the Glass-Steagall Act has made many headlines in the news. In 2013, it brought together Democratic Senator Elizabeth Warren and Republican Senator John McCain as they proposed their 21st Century Glass-Steagall Act. During the most recent presidential election campaign, it created an unexpected accord between political figures as varied as Donald Trump and Bernie Sanders. Since then, enthusiasm for the issue has exhibited few signs of waning. In April of this year, Gary Cohn, advisor to the president, publicly advocated for the legislation’s revival, and as recently as mid-May, Warren and Treasury Secretary Steven Mnuchin went head to head on the issue.

So, what exactly is the Glass-Steagall Act and why all the controversy?

The Glass-Steagall Act was passed under FDR as a response to the stock market crash of 1929. It effected a wall between commercial banking and investment banking, only to be partially repealed in 1999. While there exists consensus around what the Glass-Steagall Act pertains to, there’s disagreement around its influence on the financial markets. In particular, the debate has centered around the repeal’s effects on the 2008 financial crisis and whether it was a principal cause of the crisis. Notably, it remains relevant despite the introduction of recent legislation. In 2010, the Obama administration enacted the Dodd-Frank Act in response to the financial crisis. Similar to Glass-Steagall, it attempted to promote financial stability and protect the consumer, but Dodd-Frank did not reinstate the repealed provisions of Glass-Steagall.

The following piece examines the historical context of the Glass-Steagall Act, the erosion of its effectiveness over several decades, and its repeal in 1999. It then delves into an analysis of its impact on the 2008 financial crisis.

Historical Context and Components of the Glass-Steagall Act of 1933

In the aftermath of the 1929 stock market crash, the Pecora Commission was tasked with investigating its causes. The Commission identified issues including risky securities investments that endangered bank deposits, unsound loans made to companies in which banks were invested, and conflicts of interest. Other issues included a blurring of the distinction between uninsured and insured practices, or an abusive practice of requiring joint purchases of multiple products. Congress attempted to address these issues with the Banking Act of 1933 and other legislation.

Through Sections 16, 20, 21, and 32 of the Banking Act of 1933, Congress mandated a separation of commercial banks and securities firms. The following four provisions are what have become commonly known as the Glass-Steagall Act:

- At their simplest, Sections 20 and 32 prohibit affiliations between commercial banks and investment banks.

- Section 21 stipulates that investment banks cannot receive deposits.

- Section 16 prohibits commercial banks from investing in shares of stocks, limits them to buying and selling securities as an agent, and prohibits them from underwriting and dealing in securities. However, certain securities are exempted from the Act, collectively referred to as “bank-eligible securities.” We’ll explore why this is relevant later.

The effects of the Glass-Steagall Act can be exemplified by a familiar name: Prior to enactment, J.P. Morgan & Co. operated in both commercial banking and securities activities. However, afterward, it split into two separate firms: the investment bank, Morgan Stanley, and the commercial bank, JPMorgan.

While the effects of the Glass-Steagall Act were wide-ranging, it is equally important to note what the Glass-Steagall Act did not do. Beyond limiting the scope of activities for commercial and investment banks, the Act was not intended to limit the size or volume of such activities. Therefore, returning to the example of J.P. Morgan & Co., while the Act prohibited the bank from conducting all the same activities within a single organization, it did not prohibit the same activities (type and volume) if carried out separately through JPMorgan and Morgan Stanley.

The Glass-Steagall Act of 1933 Deteriorates

Over the course of several decades, the intended clear-cut separation between commercial and investment activities gradually deteriorated. Multiple factors contributed to this effect, including market forces, statutory changes, and the exploitation of regulatory loopholes.

As far as market forces were concerned, economic conditions such as rising inflation in the 1960s and rising market interest rates (Chart 1) during the Glass-Steagall era caused disruptions. These meant that commercial banks struggled to compete effectively, so consumers and corporate customers increasingly turned to investment banks for more lucrative products like money market funds and commercial paper. By the 1980s, the number of failed and “problem” depository institutions on the FDIC watch list rose to record levels (Chart 2).

The financial difficulties for commercial banks led to calls for regulatory changes, resulting in several laws that added to Section 16’s list of “bank-eligible securities” and helped them compete more effectively. Between 1983 and 1994, the Office of the Comptroller of the Currency (OCC) widely broadened the derivatives in which banks could deal. In addition, another major piece of legislation—the Bank Holding Act of 1956 (BHC Act)—generally mandated that bank holding companies (BHCs) were not allowed to own companies engaged in non-banking activities. Crucially, however, the act did permit BHCs to own companies engaged in activities “closely related” to banking activities. This vague language left much room for interpretation.

The Federal Reserve Board (Fed) and the OCC agencies were tasked to implement, interpret, and enforce the legislation. In interpreting the ambiguities and subtleties of Glass-Steagall and the BHC Act, the agencies gradually permitted an increasing number of activities similar to securities products and services. Higher courts allowed for a broad interpretation of the act and stated their deference to agency interpretations, leading to further loosening of restrictions originally imposed by the Glass-Steagall Act.

Aside from the above, loopholes also allowed financial institutions to bypass the separation between commercial and investment banking. For example, Section 21 of the Glass-Steagall Act was ruthlessly exploited. As mentioned previously, Section 21 prohibited investment banks from receiving deposits. However, “deposits” were defined narrowly, leading investment banks to issue short-term debt instruments that essentially functioned as the equivalent of deposits but were technically permissible. Therefore, though the banks were in compliance with the law, they violated its intention.

Repeal of the Glass-Steagall Act

By the late 1990s, the Glass-Steagall Act had essentially become ineffective. In November 1999, then-President Bill Clinton signed the Gramm-Leach-Bliley Act (GLBA) into effect. GLBA repealed Sections 20 and 32 of the Glass-Steagall Act, which had prohibited the interlocking of commercial and investment activities. The partial repeal allowed for universal banking, which combines commercial and investment banking services under one roof.

Many experts view GLBA as “ratifying, rather than revolutionizing” in that it simply formalized a change that was already ongoing. However, GLBA left intact Sections 16 and 21, which are still in place today. These continue to have practical effects on the industry today. For instance, they limit investment management firms such as Bridgewater Associates from offering checking accounts and prohibit commercial banks such as Wells Fargo from dealing in risky securities such as cattle futures.

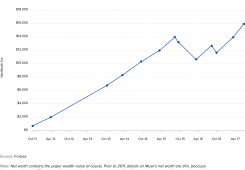

Following the repeal, the US banking sector embarked on a period of mega-mergers, creating behemoths such as Citigroup and Bank of America. The extent of this consolidation is shown graphically below.

After this period, the new six largest banks grew their assets from about 20% of GDP in 1997 to more than 60% of GDP in 2008, as shown below:

Central Debate: Did the Absence of Glass-Steagall Cause the 2008 Crisis?

In the aftermath of the 2008 financial crisis, there has been much discussion around whether the absence of Glass-Steagall’s provisions caused the crisis. Given the complexity of the issue at hand, a conclusive assessment of the issue is beyond the scope of this article. Nevertheless, we have summarized below the main topics of discussion, and what the two major schools of thought believe for each.

The Housing Bubble and Imprudent Lending Standards

Between 1998 and 2006, the housing market and housing prices rose to previously unseen highs. As many readers already know, the market’s later crash was a primary cause of the Financial Crisis. A major determinant of the housing boom was the utilization of imprudent lending standards and subsequent growth of subprime mortgage loans. Most of these loans were made to homebuyers with factors that prevented them from qualifying for a prime loan. Many subprime loans also included tricky features that kept the initial payments low but subjected borrowers to risk if interest rates rose or house prices declined. Unfortunately, when housing prices started to fall, many borrowers found that they owed more on their houses than they were worth.

According to the Financial Crisis Inquiry Commission (FCIC), which conducted the official government investigation into the crisis, the percentage of borrowers who defaulted on their mortgages months after the loan nearly doubled from 2006 to late 2007. Suspicious activity reports related to mortgage fraud grew 20-fold between 1996 and 2005, more than doubling between 2005 and 2009 (Chart 4). The losses from this fraud have been estimated at $112 billion.

Did the Glass-Steagall Act’s repeal contribute to the deterioration in underwriting standards that fueled the housing boom and eventual collapse? Predictably, opinions are divided.

On the one hand, those who believe the absence of Glass-Steagall did not cause the crisis highlight that offering mortgages has always been a core business for commercial banks, and so the banking system has always been exposed to high default rates in residential mortgages. Glass-Steagall was never intended to address or regulate loan qualification standards.

In addition, while the Glass-Steagall Act limited the investment activities of commercial banks, it did not prevent non-depositories from extending mortgages that competed with commercial banks, or from selling these mortgages to investment banks. It also did not prevent investment banks from securitizing the mortgages to then sell to institutional investors. Nor did it address the incentives of the institutions that originated mortgages or sold mortgage-related securities. Because it did not directly address these issues, it’s unlikely the Glass-Steagall Act could have prevented the decline in mortgage underwriting standards that led to the housing boom of the 2000s.

On the other hand, those who argue that the absence of Glass-Steagall did cause the crisis believe that the decline in underwriting standards was in fact partially, or indirectly, caused by the Act’s absence. Readers will recall from the beginning of the article that Glass-Steagall’s provisions addressed the conflicts of interest and other potential abuses of universal banks. After Glass-Steagall’s repeal, it is feasible that universal banks aimed to establish an initial market share in the securities market by lowering underwriting standards. Separately, universal banks might also self-deal and favor their own interests over those of their customers. Both of these incentives could have led to or exacerbated the decline in underwriting standards.

A European Central Bank study compared the default rates contained in securities issued by the investment companies to securities issued through large universal banks in the ten years following Glass-Steagall’s repeal. The study found that securities issued through the universal bank channel had “a significantly higher default rate” than those issued through pure investment companies. While the authors found no evidence of self-dealing, they did find evidence of underestimating default risk.

While these results are not entirely conclusive, it does suggest that Glass-Steagall’s absence could have worsened underwriting standards. Had Glass-Steagall been in place, these universal banking institutions would not have been created. Nevertheless, the regulation would not have prevented new, investment-only entrants also looking to gain market share. And as we’ve already mentioned, the Glass-Steagall Act never directly addressed loan qualification standards or prevented non-depositors from extending, repackaging, and selling mortgages. It’s therefore unlikely that the Glass-Steagall Act could have prevented the decline in mortgage underwriting standards, but its absence could have aggravated the situation.

“Too Big to Fail” and Systemic Risks

The second major topic of discussion related to Glass-Steagall and the financial crisis surrounds the issue of “too big to fail” and systemic risks. When the failure of an institution could result in systemic risks, whereby there would be contagious, widespread harm to financial institutions, it was deemed too big to fail (TBTF). TBTF institutions are so large, interconnected, and important that their failure would be disastrous to the greater economic system. Should they fail, the associated costs are absorbed by government and taxpayers.

The relevance of TBTF to the financial crisis was outlined by Ben Bernanke in a 2010 address, which is summarized as follows:

- These institutions will “take more risk than desirable,” expecting to receive assistance if their bets go bad;

- It creates an uneven playing field between big and small firms, which increases risk and raises the market share of TBTF firms to the detriment of financial stability; and

- Just as it did in during the crisis, the failure and near-failure of TBTF organizations disrupted financial markets, impeded credit flows, induced sharp declines in asset prices, and hurt consumer confidence.

If one accepts that systemic risk and TBTF institutions were major contributors to the 2008 crisis, then the debate turns to whether the absence of Glass-Steagall contributed to the creation of TBTF institutions and their disastrous effects. After all, the repeal of Glass-Steagall in 1999 set in motion the wave of mega-mergers that created huge financial conglomerates, many of which fall firmly within the TBTF camp.

Proponents of this philosophy point to the plight of Citigroup. The absence of Glass-Steagall permitted Citigroup (Citi) to be born through the merger of Citibank and Travelers, an insurance company. In years leading up to the crisis, Citi made huge proprietary bets and had acquired heavy exposure to securities based on subprime mortgages, eventually becoming the second largest underwriter of such securities by 2006. As the housing crisis shook the markets, Citi was hit hard, eventually requiring the largest financial bailout in history, to the tune of $476.2 billion in funding from the Troubled Assets Relief Program and taxpayers’ wallets.

However, aside from Citigroup, most of the other severely distressed institutions in the financial crisis were not commercial banks. As financial columnist Andrew Sorkin points out, Bear Stearns and Lehman Brothers were both pure investment banks with no ties to commercial banking. Merrill Lynch, another investment bank that ended up being rescued, was similarly unaffected by Glass-Steagall. American International Group (AIG), an insurance company, was on the brink of failure, but it sat outside the purview of Glass-Steagall. As for Bank of America, its major issues stemmed from its acquisition of Countrywide Financial, a subprime lender that had made poor loans—something permissible under Glass-Steagall.

Ironically, Glass-Steagall’s repeal actually allowed for the rescue of many large institutions after the crisis: After all, JPMorgan Chase rescued Bear Stearns and Bank of America rescued Merrill Lynch, which would have been impermissible prior to the 1999 repeal. Both were already involved in commercial and investment banking when they saved the two failing investment banks. On balance, therefore, the evidence does not seem to support the view that Glass-Steagall’s absence was a cause of the financial crisis.

Shadow Banking and Securities Market Turbulence

Another topic related to Glass-Steagall and the financial crisis revolves around the rise of shadow banking, which many believe was a primary cause of the crisis. According to Ben Bernanke, shadow banking typically involves financial intermediaries that carry out banking functions but operate separately from the traditional system of regulated depository institutions. These activities generate liquidity through capital markets and are not FDIC-insured.

Practical examples of what sort of institutions and activities operated in the shadow banking sector are varied. Let’s examine the repurchase agreement market (repo market), a market for short-term, collateralized loans. The repo market works as follows: Depositors (institutional investors and large corporations) need a place to park liquid funds that pay an interest rate higher than that offered by commercial banks. Bankers (investment banks and broker-dealer firms) are willing to provide such a product in the form of repo transactions. In return, the lender receives safe, liquid collateral, so that if the borrower is unable to return the funds, the lender will simply seize the collateral.

In the years leading up to the crisis, the repo market exploded, growing from $2 trillion in 1997 to $7 trillion in 2008. Consequently, the demand for safe collateral for these repo agreements grew too. Mortgage-backed securities, an innovative financial product, helped satisfy this demand for collateral. Commercial banks make loans to consumers and business, but instead of holding these on their balance sheets, they can sell them to shell companies. Shell companies fund the acquisition of these assets by issuing asset-backed securities (ABS) such as mortgage-backed securities that become the liabilities of shell companies and are sold to investors in the capital markets.

The example of the repo market is relevant for several reasons. First, the growth of the repo market was indicative of the overall growth in the shadow banking market (Chart 5 above). Second, it played a particularly significant role in the crisis: the aforementioned US housing boom was financed largely in this way. Lastly, and perhaps most importantly, the repo market and the related MBS markets are illustrative of shadow banking’s complexity (Figure 3). At each step in the process, the true quality of the underlying collateral is further obscured and more loans are included with each link added to the chain. While, in theory, this diversifies risk, it also obfuscates the evaluation of the quality of individual pieces. The result of all this, of course, is that when confidence erodes, the structures come crumbling down as investors are unable to assess the true extent of the risks involved in these transactions.

It is generally accepted that shadow banking was an important determinant of the financial crisis of 2008. However, many debate whether Glass-Steagall would have curtailed shadow banking’s growth and, consequently, the financial crisis.

At a surface level, the shadow banking activities linked to the financial crisis were not prohibited by or relevant to the Glass-Steagall Act. As more activities previously conducted within the commercial banking sector shifted to this parallel and unregulated market, riskier behavior emerged and underwriting and lending standards slipped. But crucially, these new shadow banking markets were outside the purview of Glass-Steagall and the Banking Act. If anything, many argue that the real regulatory culprit was the Commodity Futures Modernization Act of 2000, which deregulated over-the-counter derivatives. Banning regulators from restricting these activities sent a strong “anything-goes” message to the derivatives markets.

However, on a deeper level, many question whether the absence of Glass-Steagall indirectly allowed for shadow banking to propagate. And crucially, it comes down to whether the commercial-banking sector, using its FDIC-insured consumer deposits, funded the sector’s growth, and whether this would have been permissible under the Glass-Steagall Act.

In a January 2016 interview, Bernie Sanders charged, “Secretary Clinton says that Glass-Steagall would not have prevented the financial crisis because shadow banks like AIG and Lehman Brothers, not big commercial banks, were the real culprits. Shadow banks did gamble recklessly, but where did that money come from? It came from the federally insured bank deposits of big commercial banks—something that would have been banned under the Glass-Steagall Act.” Warren Gunnels, Sanders’ chief policy aide, further explicated, “Commercial banks provided the funding to shadow banks in the form of mortgages, repurchase agreements, and lines of credit. Further, commercial banks played a crucial role as buyers and sellers of mortgage-backed securities, credit-default swaps, and other derivatives. This would not have happened without the watering down of Glass-Steagall in the 1980s and the eventual repeal of Glass-Steagall in 1999.”

The general consensus among experts is that these allegations are incorrect. According to Lawrence J. White, an expert on financial regulation at New York University, “Commercial banks could have done all of those things in the 1960s or earlier, even before the Fed and the OCC court decisions began to loosen the structures of Glass-Steagall.” Phillip Wallach, Brookings Institution fellow, adds that “The rise of mortgage-backed securities doesn’t strike me as obviously inconsistent with Glass-Steagall.” However, commercial banks were not blameless. Commercial banks used the shadow banking system to move liquidity and credit risk off their balance sheets, transferring it outside of traditional banking—risks that were not eliminated from the financial system. Still, these activities likely would have been permitted under Glass-Steagall.

Regarding Sanders’ specific mentions of Lehman Brothers and AIG, the FCIC concluded that Lehman Brothers relied primarily on non-bank sources of funding, therefore not endangering deposits. As for AIG, which eventually required a $180 billion federal bailout, “enormous sales of credit default swaps were made without putting up initial collateral, setting aside capital reserves, or hedging its exposure—a profound failure in corporate governance.” The FCIC concluded that this was possible due to the deregulation of derivatives, specifically the aforementioned Commodity Futures Modernization Act of 2000.

While one could make a case that shadow banking markets were the product of a deregulatory environment, further reinforced by the repeal of Glass-Steagall, strictly speaking, the absence of Glass-Steagall cannot be considered as a cause of the market’s growth. Had the Glass-Steagall Act been in full force, its prohibition of commercial and investment banking affiliations would not have prevented the opaque transparency in product risks and the subsequent investor panics that resulted.

“Like Icarus, they never feared flying ever closer to the sun”

It is difficult to reach a definitive conclusion regarding the impact of Glass-Steagall’s absence on the financial crisis. The culprits and causes of the crisis were many and varied, and to single out one factor would be to oversimplify the truth. With that said, the general consensus among academics and finance experts seems to be that Glass-Steagall’s absence was probably not to blame for the 2008 crisis. Even Elizabeth Warren, champion of its revival, acknowledged that the crisis could not have been avoided even if Glass-Steagall had still been in place. Former Treasury Secretary Tim Geithner also dismisses its role in the crisis. And Paul Krugman, a strong proponent of financial services regulation concurs: “Repealing Glass-Steagall was a mistake. But it did not cause the financial crisis.”

Ultimately, one cannot overlook the findings of the Financial Crisis Inquiry Commission, a nonpartisan institution whose 500-page report concluded that “Neither the Community Reinvestment Act nor removal of the Glass-Steagall firewall was a significant cause. The crisis can be explained without resorting to these factors.”

Still, there is credence in an oft-overlooked, indirect cause of the Act’s absence: the creation of a reckless, risk-taking, profit-focused culture on Wall Street. In fact, economic Nobel Prize laureate Joseph Stiglitz included this cultural shift as one of his five major contributing factors to the recession: “The most important consequence of the repeal of Glass-Steagall was indirect—it lay in the way repeal changed an entire culture […] When the repeal of Glass-Steagall brought investment and commercial banks together, the investment-bank culture came out on top. There was a demand for the kind of high returns that could be obtained only through high leverage and big risk taking.”

This mindset and resulting reckless culture, though intangible, were undoubtedly real. As some experts assert, the investment banking culture of risk-taking, focus on short-term profits, and deprioritization of client interests was at the heart of the crisis—which may not have been present, or would at least have been minimized, with Glass-Steagall. The FCIC report sums it up best: “The large investment banks […] focused their activities increasingly on risky trading activities that produced hefty profits […] Like Icarus, they never feared flying ever closer to the sun.”